Everyone in the printing business should watch the video that demonstrates the iPad app Flipboard.

Everyone in the printing business should watch the video that demonstrates the iPad app

Flipboard. There's other iPad news: where businesses were afraid of the iPhone, preferring the Blackberry as a corporate standard,

some businesses are already starting to issue iPads.

* * *

Also becoming more popular are GPS-based mobile marketing capabilities. I've mentioned

Foursquare before, but now Facebook has started a service called

Places. In case you were wondering, Facebook now has more than 500 million users, of which nearly a third access by mobile device or both.

* * *

Some of the comments about

Facebook not being valuable to marketers in some quarters are rather amusing.

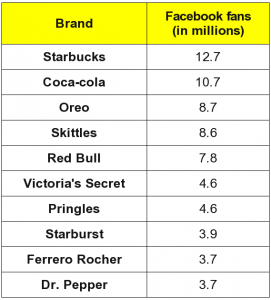

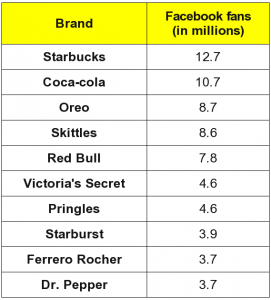

An article in Advertising Age explained how companies are concerned about Facebook taking away traffic from their web sites. When analyzed, however, those brands that were active on Facebook maintained their web traffic when others did not. The fact is that anything we knew about social media a year ago is dreadfully out of date. Here are data from the

AdAge article about how many Facebook “friends” there are of major brands:

The traditional use of media has measured effectiveness in terms of leads. That's great, but once you have them, what do you do? You need to keep them engaged, and you need to encourage word of mouth to new users and nurture the loyalty of the customer base. The tools to do that were not all that good or measurable prior to social media. The rules of social media are still being written, especially in B2B markets where social media is still very new.

Just think of how much media have changed in three years:

- 50+ million iPhones

- 190 million accesses to Twitter every month

- 500+ million Facebook users

- Facebook Mobile has 150+ million users

- More than 1 million Apple iPads sold per month

This is why focusing on economic conditions as the catalyst for improvement in print volumes is misplaced. We're having a communications revolution playing out in handheld devices that is in many ways more powerful that the introduction of the telegraph, radio, and television. Technology is stronger than the effects of any general economic upturn or downturn.

* * *

Facebook's company value is now estimated at

more than $33 billion according to the

Financial Times. To put that in perspective, if you took more than four months of all of the output of the U.S. commercial printing industry, you could trade it for Facebook. This valuation puts it at about 80

th in the

Financial Times listing of top 500 US companies by market value, about in line with companies like DuPont and Corning, larger than FedEx, and about twice the value of Adobe.

* * *

I am annually disappointed by the lack of high profile printing industry involvement in shows like ad:tech New York. At the time of this writing,

no printer or organization is exhibiting at the show. Seventy percent of the attendees are publishers, agency personnel, and advertisers. If we want to be considered as prominent players in the new communications marketplace, we should consider the advice of Woody Allen: “eighty percent of success is showing up.”

* * *

Part of the new relationship of printer and client is to help make their e-marketing more effective. A recent (free!)

Return Path report reviews several e-mail campaigns to re-engage chronic non-respondents to e-mail offers. The report doesn't mention it, but print can be built into those programs to renew the customer relationship. Bring Return Path's ideas, and your own, to your clients.

* * *

Back in 2007, marketers were advised to allocate their digital and media budgets to three screens: TV, PC, and mobile (phones). Three years later, the six-screen strategy is now coming into play. Added are mobile computing (iPad, netbooks), location aware digital TV, and what is called the “infinite 'pull' screen of convergence.” The last two require the rollout of new 4G networks. An

article in Advertising Age describes this: “...communications device will be coupled with an HD-powered screen; integrating community-communications with entertainment and soon full-blown interactivity.” Think of it as the second generation iPad. The last item, that “infinite 'pull' screen of convergence” is where people manage all of their communications and networking. BoSacks has described this over the years as a “digital concierge,” but not even the erstwhile BoSacks could have known about social media at the time.

Are our entrepreneurs ready to thrive in this kind of environment, and bring the ideas, the infrastructure, and the discipline of wise content deployment to their clients?

* * *

The

recent downturn in existing home sales should not be a surprise, and is further evidence that temporary tax benefits impede the natural flow of economic activity. House prices are generally falling again, or have the propensity to fall (that same report indicated the inventory of existing homes is at an 11-year high), which is a reason why many homeowners are holding off adding their homes on the market. This means that the market will not clear out to a natural equilibrium for quite a while, perhaps as long as five years from now. There has been some discussion in

Barron's and other sources that this will spur growth in renting, especially for relocations, rather than buying. The mortgage crisis is not over; there are sentiments in Washington to fund forgiveness of portions of some mortgages through FNMA and Freddie Mac with yet more tax dollars and borrowing. As far as more housing credits to stave off more deflation in home prices, that is the wrong place to look for a rebound. Rising incomes raise demand for homes and stabilize and then increase home prices. The old line about when all you have is a hammer, everything looks like a nail describes the constant tinkering of tax policy. Economic animal spirits seem so vague and unpredictable that tax policies are all the more attractive, like the hammer. And all of this is happening with the

money supply is still so tremendous, and the Fed continues to buy government debt almost as soon as it is offered to keep interest rates abnormally low.

The rather dour outlook on Wall Street of the last few days is a disturbing, of course. I have not heard this, but this might be in reaction to the increase in taxes on dividends, so that assuming a constant rate of dividends, the underlying stock price has to decrease to offer the same after-tax yield. Assuming the S&P 500 is at 1100 with a 3% yield, the after tax rate is 2.55% at 15%. Raising it to 20% requires the S&P to go up to about 1168 to result in the same net amount of dollar dividends. If the tax on dividends is increased to 40%, the S&P has to rise to 1565 to result in the same amount of dollars. In the other direction, to result in the same net after tax yield, the S&P would need to drop by about 6% if the tax rate on dividends is raised to 20%, and if they are raised to 40%, down to about 770 to create a pre-tax yield that would result in the same net after-tax yield of today. If a contributing cause of the recent stock market retrenchment is an adjustment for future tax rates, no wonder there is a rush to Treasuries and corporate bonds and away from stocks. The fear of stock market volatility is real, especially when the market is -40% below its inflation-adjusted 2000 high (the NASDAQ would have to more than double). There are other

dark scenarios being proposed, and perhaps the increasing frequency of these dire forecasts is a sign that we are finally at a bottom of the fear.

Another claimed analyst surprise was that student loan debt is starting

to exceed credit card debt. A consumer who juggles both credit-card and student-loan debt is likely to pay of the credit-card first, as that debt tends to carry a higher interest rate. Of course, it's the only rational thing to do. Credit cards have higher rates because they are unsecured, and the bulk of student loan interest rates are below market because of regulation or government subsidy. Just like the mortgage market became a problem because of selling to buyers of dubious financial status, and the tax laws favored using mortgages to free up cash for other spending, there is every incentive to borrow as much as possible for as long a period of time for student loans, which frees up money from other sources. If all borrowing received the equal treatment, bubbles would be less likely to form. The regulatory preference for education spending is why the long-term trend of education cost inflation is 2x the Consumer Price Index.

* * *

Friday, August 27, is the update of the second quarter GDP. Because of the way the WTT editorial calendar is planned in relation to the Labor Day holiday, I do not have a column again until September 13. Be sure to watch this blog and

Twitter for the latest economic comments until that time, as well as the weekly ERC newsletter.

The traditional use of media has measured effectiveness in terms of leads. That's great, but once you have them, what do you do? You need to keep them engaged, and you need to encourage word of mouth to new users and nurture the loyalty of the customer base. The tools to do that were not all that good or measurable prior to social media. The rules of social media are still being written, especially in B2B markets where social media is still very new.

Just think of how much media have changed in three years:

The traditional use of media has measured effectiveness in terms of leads. That's great, but once you have them, what do you do? You need to keep them engaged, and you need to encourage word of mouth to new users and nurture the loyalty of the customer base. The tools to do that were not all that good or measurable prior to social media. The rules of social media are still being written, especially in B2B markets where social media is still very new.

Just think of how much media have changed in three years: