For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

Commentary & Analysis

The Economy is Slowing... What Does that Mean for Us?

Tuesday'

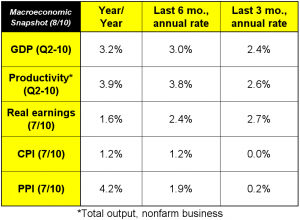

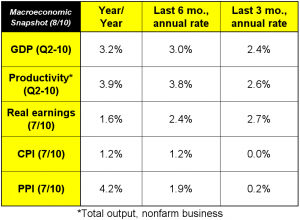

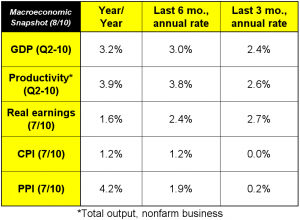

Tuesday's Producer Price Index data showed that finished goods prices have been flat for approximately the last half year, but compared to this time last year, it's up 4.2%. The prices that consumers are paying, measured by the Consumer Price Index, are flat with last year. This means that prices of goods and services providers are up, but they're not showing up in the prices of goods on store shelves. When goods go up in price, but they can't be passed in the marketplace, the shortfall is made up somewhere else, usually by reducing other costs, such as keeping headcounts low.

For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

For this reason, I found the interest in the Federal Reserve's Industrial Production Index to be quite curious. Sure, a 1% rise on a month-to-month basis is big (multiply it by 12 to see why) but a closer look at the data showed that capacity was reduced. There were also seasonal adjustments that may not play out the same way this year as they have in others. But the decrease in capacity meant that more output was being achieved in less time. That's a good idea, of course, and it's called productivity. But where does it lead? In the full context of the economic situation, the productivity is the result of increased emphasis on efficiency. In recoveries, this builds up resources that can be used for expansion, but this recovery is not that kind. There is no sign of an imminent expansion, and there are signs that the economy is slowing. So the efficiency kick is a reflection of skepticism about economic conditions, and the knowledge that other costs are going to rise in the very near future (2011, less than five months away). Those upcoming costs have to be paid and accounted for in the way operations are run in the future. The difference between the PPI and the CPI is paid for by investments in efficiency.

Other data were released that implied that GDP for the second quarter will be revised down from +2.4% to +1%, with a consensus seeming to form at +1.2%. These were trade data and data about retail sales. GDP is still positive, but it will start feeling like a recession again, especially in terms of unemployment. The extension of unemployment benefits has the unintended consequence of keeping the unemployment rate high, and the fact that GDP growth is lower than productivity, a sign yet again of efficiency rather than expansion, there is little reason to hire additional employees. Therefore, unemployment rates are unlikely to improve in the near term.

UPDATE 8/19/2010 8:45am EDT Weekly jobless claims report was very disappointing, making it three weeks in a row that "experts" were surprised by the rise in claims. The figure was 500,000, +12,000 from the prior week. Because the report of one week can have some seasonal adjustment or other factors, it's better to look at the 4-week moving average. That was up +8,000, and is now 482,500. This is obviously not a good sign of things as initial claims seem to have been their best in February of this year and have been slowly deteriorating through these last six months.

There is good reason to continue to be cautious, limit debt, and continue to seek opportunities to consolidate sales volumes with other print businesses in whatever consolidation format makes sense. Stay away from traditional forms of doing business, but do not depart from the idea that one can tolerate unprofitable periods during a restructuring.

As I have advised earlier, recessionary periods are often times of increased technological displacement. Because costs are under pressure in all parts of corporate customers, and hunkering down becomes a way of life for small and microbusinesses, there is greater curiosity about new approaches for their needs, and less interest in loyalty to supposed traditional ways of doing things. As long as you are positioned to undermine those traditions with new ideas, you can find greater receptiveness than you might have experienced in boom times.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.