Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

Commentary & Analysis

Even the Fed Worries about a Continuing Downturn

The L-

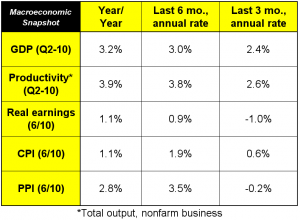

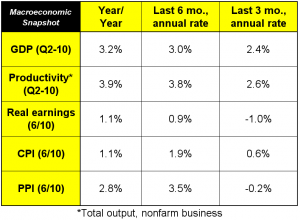

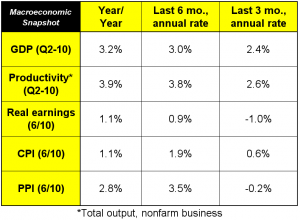

The L-shaped recovery is now causing a panic. A look at our economic summary explains the concern. GDP has already gone below the post-WW2 average, and we're supposedly in a recovery, which usually means 4-7% growth for a few quarters. GDP has not even reached the level it was at the start of the recession.

Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

Productivity was reported as being negation, which is the hourly rate of productivity, but the total output figure was much better, even if it was lower. The real problem for employment is that productivity is greater than GDP growth, which means there is little reason, in the aggregate sense, to anticipate any rise in hiring.

So the economy is slow, but just look at how the Federal Reserve Open Market Committee explains it:

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

There, that was simple! Time to translate: Despite everything we're doing, the economy is slowing down, and we're really so confused that it's happening, but we really do hope it gets better. (Gosh, that was about 100 words less!)

So the upshot of the Fed's meeting this week is that they're going to continue their policies of interest rates at virtually zero, making any safe savings instruments lose value, even when inflation is below 2%. Increasing government spending money is not working, loose money is not working, but they will continue anyway. One day, they might get lucky, they hope.

I try to stay out of anecdotal stuff about the economy, but I've already had two personal situations concerning how unemployment benefits are keeping people from going to work. One was with a woodworker I know whose company just shut down. His feeling is that he will take the unemployment, and even though he may have to give up a few things, he'll have time to work on the house he purchased. Combined with his wife's pay, it will be a manageable time and he'll look for work when the benefits start to run out unless something comes up sooner. There was another situation where a contractor we're working with said he had hired a site manager to start working so that he could get more time to expand his business. The new site manager had just called to say he wasn't taking the job because he qualified for the extended benefits and wanted to take advantage of those now that they were available. Economists have known for a long time that at some point that unemployment benefits stop being humane and then become a drag on employment that prevents the redeployment of workers to more productive activities rather than letting their skills erode or be deterred from getting new skills. The Wall Street Journal had two articles that got extra attention this week. One was about companies that cannot find workers despite the high unemployment rate, and the other was by an employer explaining why they won't be hiring.

The National Federation of Independent Business (NFIB) small business survey took another turn down. Their press release said “Ninety percent of the decline this month resulted from deterioration in the outlook for business conditions in the next six months... The small business sector is not on a sustained positive trajectory, and with this half of the private sector missing in action, the economy’s poor growth performance is not surprising.”

This Friday and next week we get the CPI and PPI updates. They will be flat for the most part, but we'll update the chart above with those data in next week's newsletter.

As businesspeople, our decisions are for the long term but we navigate the short term keeping those long term goals as a guide. Supposedly, businesspeople are reluctant to invest or take decisive action because of the great uncertainty that hangs over the marketplace. I believe the opposite: they are certain what's ahead and are preparing.

If you're a printer, work with what's certain. Keep restructuring, keep working on your product mix (use the media chart to help) and update it. Little used equipment is best removed from the shop: it ties up employee resources and prevents them from knowing their mainstream tasks better. Any equipment that works but has no marketing life left to it unnecessarily ties up capital. Don't be stuck with a shop that's very efficient on the shop floor but wastes all those earned margin dollars on inefficient sales and administrative matters. What good is quick turnaround if invoicing takes forever? Most of all, become familiar with all of the new commuications formats, and use them. Find designers, and especially public relations experts in social media and new forms of real-time communications with whom you can effectively partner. If you don't have an iPhone, buy one and use it. Ditto for an iPad. The next big tech horizon is mobile rich media commuications. We've seen just the edge of it, and only the print businesses that can get ahead of the applications for that, whether or not print meshes with them all of the time, can find opportunities in them. These are all trends that will move forward whether the economy is slow or booming. Work with those certainties and most of the other economic worries will take care of themselves.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.