Commentary & Analysis

Recovery Indicators Retreat

For the past few months,

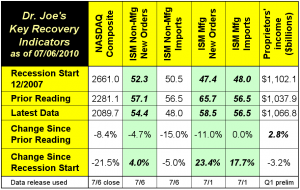

For the past few months, four of our six recovery indicators were in positive territory; now we are down to three. The NASDAQ took a beating, down -8.4% since last month. Proprietors' income for Q1 was revised up slightly. Neither of these data have reached their pre-recession levels.

The four Institute for Supply Management indicators have been positive for quite a while, but imports by non-manufacturing businesses were down, and are back under pre-recession levels. The entire ISM non-manufacturing report was a retreat from prior levels, even though the overall report showed growth, but slower growth, for those sectors. Among the caution flags raised by the report were that exports and employment are now declining.

The ISM manufacturing report held steady for imports but fell back for new orders. Both are still at healthy levels indicating growth, and are well above pre-recession levels.

The economy is in some trouble, but the double dip recession is unlikely. Just slow, stagnant growth that makes managing all the more challenging.

The four Institute for Supply Management indicators have been positive for quite a while, but imports by non-manufacturing businesses were down, and are back under pre-recession levels. The entire ISM non-manufacturing report was a retreat from prior levels, even though the overall report showed growth, but slower growth, for those sectors. Among the caution flags raised by the report were that exports and employment are now declining.

The ISM manufacturing report held steady for imports but fell back for new orders. Both are still at healthy levels indicating growth, and are well above pre-recession levels.

The economy is in some trouble, but the double dip recession is unlikely. Just slow, stagnant growth that makes managing all the more challenging.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.