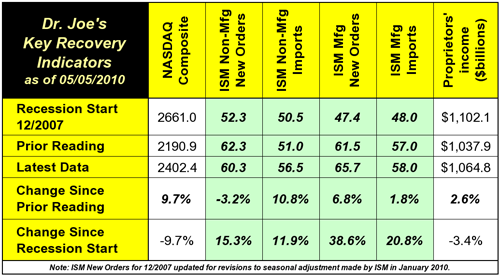

The economy is definitely not roaring back, but it is getting better. We now have all four Institute for Supply Management indicators firmly in positive territory. Last month, non-manufacturing imports was only barely so.

Proprietor's income, a good measure of the health of small business, still lags Q4-2007 levels, but did increase since last quarter. This past week's chart discussed this indicator in more detail. The data in the recovery indicators chart is not adjusted for inflation.

Neither is the NASDAQ, of course, but there is some hopeful news there. As I write this, the stock markets have had a very rough few days as concerns about Greece's debt, the Gulf oil spill, so it's easy to forget that the index is more than 200 points higher than it was last month.

On Friday, the latest unemployment report will be released. If the unemployment rate goes up, dig into the press release and see if the civilian workforce expanded. If so, that will be great news as it means that people are coming back to the workforce, just at a rate too fast for the market to absorb it. The way the rate is calculated, that means it's actually good news, even if the headlines don't say so.

We'll have a complete wrap-up in Monday's column.