It's tough for many managers to really grasp this aspect of their work: they are in charge of nothing other than their costs. They can't control market prices, even though their job requires that they always have an understanding of profits. They can't control profits, because they can't control prices, but they can't control the purchase decisions people make. They can influence them, but they can't control them.

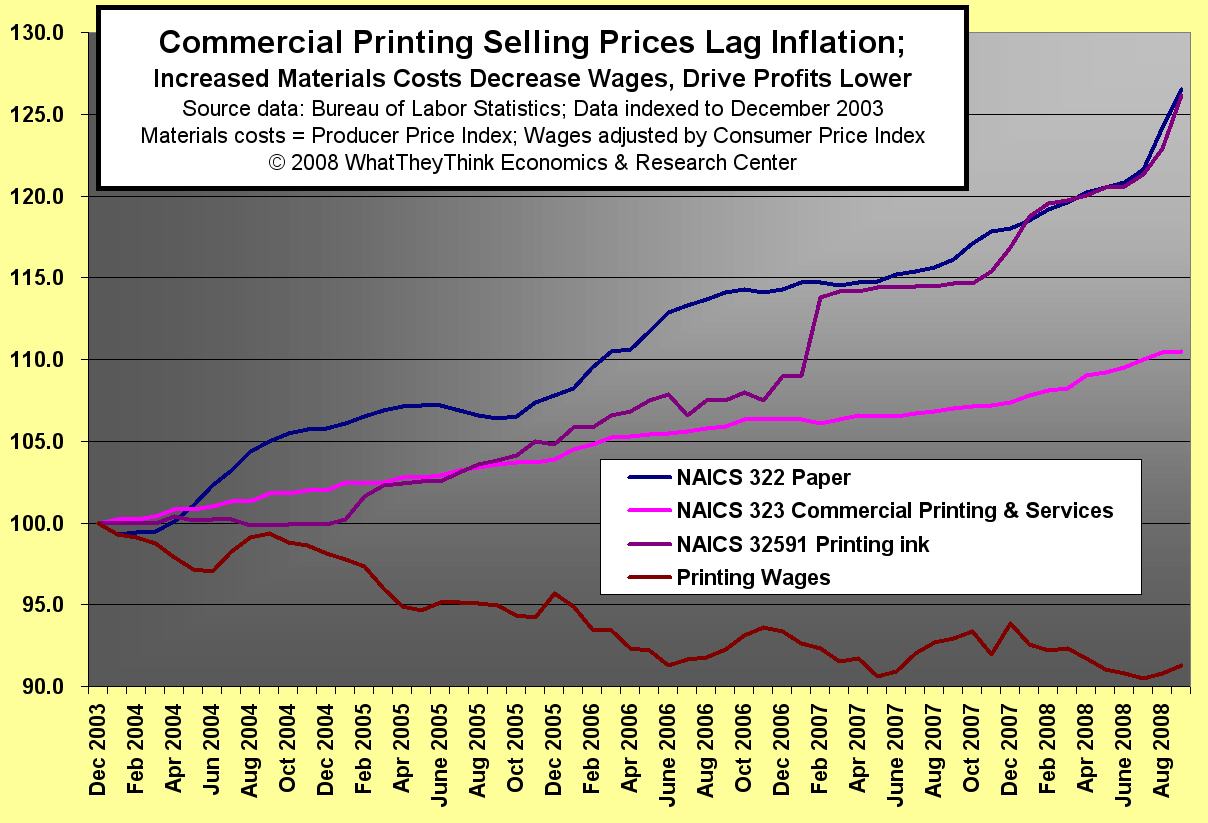

The chart below made this quite clear to me. It shows the changes in prices, using the producer price index, of paper, and commercial printing. It also shows wages of production workers in printing.

Since 2003, it's very clear that paper and ink prices are up about 27% while printing prices are up only a bit more than 10%. We know from some of our other reports that profits are down considerably, especially in the last quarter, and inflation-adjusted hourly wages are down about 8%. Remember, in rough terms, the printer's income statement shows that paper and wages are about equal, around 25% each, of the print sales dollar. Because print prices are under intense pressure from new media and desktop and other personal printing technologies, postal fees that lack direct competition, and a reward of avoiding print is green admiration, there has to be a crack in accepted industry operating conditions somewhere.

That crack in printing business management has to come with new investment. Remember, a cost is not an expense. A cost is a use of funds for which you expect a financial return. Remember your income statement: it doesn't say “expense of goods sold.”

Therefore the common phrase “we have to cut costs” is actually wrong. How come? Costs are the result of investment and training decisions of years past. These data series indicate that there is a great mismatch between the industry's costs and pricing. Remember, pricing is not determined by print businesses, but prices are a reflection of the value of the benefits derived from using a product as perceived by its buyers at a particular point in time. Prices change constantly: costs do not.

So that's where we find ourselves. Our costs are the residue of investments made with assumptions about what the future was going to be like. Today is that future, and it's quite different than what most everyone expected.

This is what makes trade shows like Graph Expo so important. It's a chance to look at your costs, yesterday, today, and tomorrow, in relation to what the market will look like. These are the undeniable truths of what is ahead of us: print prices will not be allowed to rise. Materials costs may come down, but will be slow to do so. Lower wages will make attracting and retaining workers harder as they are drawn elsewhere. Those workers are headed to content creation markets that are still growing. These are all clues that investments need to change costs, reduce management time, increase predictability, and enhance the connectivity of workflow not just inside the plant but as a window to content creation and content deployment. Labor costs become capital costs.

The objective is not to cut costs, but to organically change the nature of costs, and that requires investment in the right things. What good is running a 10 or 15 year old press purchased for the market of 1998? You then have 1998's costs in 2008's market. It's not just a press, it affects everything.

Now for my shameless plugs: my free downloadable book, “Renewing the Printing Industry” covers these issues. I'll talk about the future at various places during Graph Expo, especially the Tuesday morning event at the show.

Miscellaneous Stuff

Print Buyer guru and hero Margie Dana writes in her newsletter after listening to a recent Dr. Joe audio chart of the week: “Now I know what a conference attendee meant when he stopped me on his way to the reception at our buyers conference last month. He'd just come from Dr. Joe's session on “It's 2018: Did Printing Survive?” and said as he whizzed past me, “I'm heading to the bar: I just heard Dr. Joe.”

Advertising Age has noted that agency spending is being scrutinized very carefully by clients. This always happens when economies get rough, but it's important to remember that these are great times to get into clients you don't have because they often change suppliers in search of better costs and better service.

AdWeek describes how the use of advertising and new media are changing in the auto market. This is essential reading: "Car Biz Driven to Despair."

Sure, six months ago I mention “shoe” in a headline. Now an association blog mentions “shoe,” too! At least I mention the direction the shoe was headed. The association blog just mentioned “....” :) Now what is it that fascinates us economic types with shoes... come to think of it, let's not go there.

I love my little Asus Eee 900 netbook. It's been doing quite well in the world market for notebook computers, and there are more on the way. Mine came with Xandros' really scaled down Linux software, but I loaded Ubuntu-eee instead for a much fuller experience. The Eee is great in tight seating on planes, and for a quick check for e-mail or to dump some text into a word processing document when you're on the go.