Three unrelated things give us important lessons about slow economic times and why the urgency to act never takes a holiday.

Technology moves whether there is a recession or not, and slow times may even intensify technology adoption. I was reminded of this with the announcement by Qualcomm of a computer that will use cell phone chips to allow connectivity to those in range of cell phone networks but do not have access for a variety of reasons. The equipment will be sold primarily in India, Africa, and other areas that typically cannot afford “conventional personal computers,” as described by the Wall Street Journal. There is more information on ZDNet. The access to information at any time by any one has always been hindered because “any place” was not always practical. Eventually, users may not even know what kind of access they have but will be immersed in connectivity wherever they go. Our competition with new media cannot take a rest to act when things “get better.”

It is clear that the Federal Reserve and the current and incoming administrations have taken a path that is distinctly Keynesian (even though he promised to be dead). This assumption that consumer purchases stimulate the economy and not goods production is stark. Investment is critical to get out of the economic and inflation problems. One of the best discussions of this was the article by Robert P. Murphy. I have rarely seen an article that covers as much ground, and so well, of a rather dry subject, especially for those who are not economics-inclined. Investment in new technologies and those who use them (those are called employees, by the way) is more essential in difficult times. There is more incentive to change operations and suppliers than ever at times like these, and all assumptions about purchase patterns and their predictability go out the window. These are times when a client's problems are more pronounced and deeper, often with greater opportunities to help solve them with our services. That is, if we have the right services.

Technologies wait for no one, and problems needing our solution are increase during economic stress. That stress is only intensified with poor solutions, creating a marketplace with problems not of our own making.

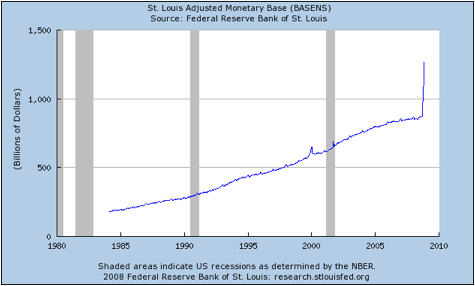

I was rattled when I saw this chart about the money supply.

Note the rapid turn upward , showing the dramatic flood of money sent to the market by the Federal Reserve. This is at a time when the production of goods and services is heading down, significantly, as indicated by the latest reports of the Institute for Supply Management. Too much money, too few goods, and you get inflation. It's not of our making, but we have to leverage the marketplace to our advantage. It tells us what clients will be looking for almost exclusively. Despite the day-to-day confusion of the news, future problems can still be seen.

The biggest problem ahead is the rise in costs that are coming to constrain corporate communications budgets. If you complained about market prices of print before, you will be complaining yet more. I have been speaking around the country about how our industry needs to revolutionize its capital base to change our costs. We also have to keep an eye out for changing our client's costs.

Remember that costs are outflows of resources for which an economic return is expected. This is why some communicators refer to their “ROI” for projects or initiatives.

When the market creates conditions that thwart investment, such as the inflation in poor fiscal and monetary policies are and will do, they also make it the most the best time to do it from a competitive perspective.

Printing clients will be demanding better and lower prices, and their insistence on them may not be verbal, but a more aggressive search for suppliers. Companies who tried to limit the number of suppliers they dealt with will now be shopping in the printing bazaar. In such situations, every printer starts to look the same.

Few print companies can rise to this occasion without drastic changes to their core operations. We know by the chart above that inflation will increase and that clients will be dealing with even higher cost management problems than they have today. This may seem hard to believe. Prepare now.

Recessions are times for decisive competitive action. When everyone else is demoralized, that is usually the prime time to act. Lower your client's costs with insightful use of new print technologies, knowledge of postal options and alternatives, thoughtful applications of new media techniques, and creating opportunities for them to outsource management and administration of communications tasks to your business as they downsize or reallocate tasks.

Get out ahead of this before your competitors.