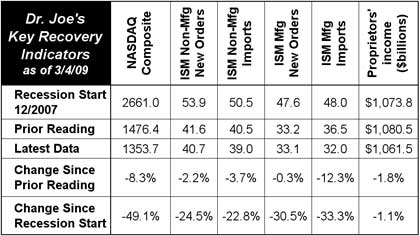

Over the last month, our selected economic recovery indicators took a shot to the chin. Every single item was down. Good thing it was a short month! I still think we're at a bottom, but I certainly “got the willies” a few times during the month. It's sideways from here for a while.

Over the past two years, businesses were starting to slow their investment with the uncertainty of what tax rates and inflation would be. When conducting a net present value analysis of a long term project, these are critical items in the calculation because they do compound. Whatever was uncertain at that time has now moved to certainty. Tax rates will be going up, and there is a feeling among business people that inflation will return because other than energy, they have not seen their other costs decrease. In my opinion, the decrease in the equity markets moved from uncertainty last year to certainty since February as various bailout and stimulus programs were introduced or passed. Even the Congressional Budget Office has told Congress that increased government borrowing will decrease economic activity and wages because they will crowd out investment dollars.

Our recovery indicators did not do well this month. We know the stock market tanked yet more than it had already, as indicated by the NASDAQ composite index. Stock prices are based on expectations of future profits. Sometimes those expectations are unrealistic, as they were in the Internet bubble and the housing bubble. But we need to see a change here because there is a great deal of profits skepticism, and upside will be a good sign, and I don't think it will be a false signal when it breaks out of its trading range. The question is how long it will take to get up to it's December 2007 level. Remember, a -50% decline has to be replaced by a 100% increase to end up at the starting point. That will be hard work.

The ISM non-manufacturing new orders index decreased since last month, and imports were down as well. The ISM manufacturing index was virtually unchanged, but the imports there were down yet further. Raw materials come in from overseas and are used in manufacturing in the U.S.; no manufacturing activity, no imports. Proprietors income is reported quarterly, so the “latest data” figure just shows the revision from the Bureau of Economic Analysis for the fourth quarter of 2008. It was revised up very slightly. We won't get a first quarter figure until the end of April; I'm not expecting it to rise.

The recovery indicators were better last month than this time. This is obviously disappointing. It will be a slow trudge out from these levels, with ups and downs that will drive us batty. Until we start getting consistent improvement to the upside, we won't be able to say that a recovery has taken hold.