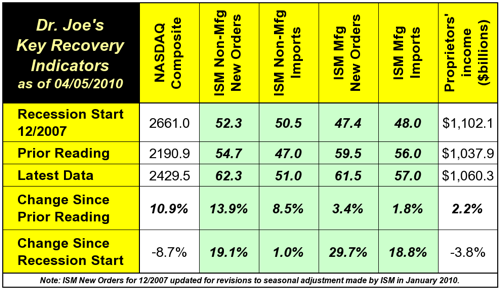

Four of the six recovery indicators are above their recession start levels, and three of those are markedly so. The NASDAQ index, which we selected over the Dow and S&P 500 because it included less financial exposure has had a strong month, and not just because of the interest in Apple and its iPad release. Even though the NASDAQ is below is December 2007 level, its surge is encouraging, and it is about 10% more to go before it surpasses its recession start mark.

There are numerous economic factors that are in favor of the NASDAQ continuing its growth, one of the strongest is the general regulatory pressure to minimize the number of employees and increase productivity. This means that the tech sector is likely to have good growth (and paradoxically, increasing employment while other sectors hold steady) as companies invest in communications and computing technologies.

Proprietors' income, the measure we use to get a picture of small business activity, has been close to its December 2007 start, but has remained a bit stubborn. This data point is released quarterly, so we still have the fourth quarter of 2009 in our chart. When it was revised recently, it was revised down.

Our first look at GDP for the first quarter of this year won't be until April 30. It is quite possible that proprietors income will finally break through and also move into positive territory. GDP growth in the fourth quarter was above 5%, but it was based mainly on inventory replacement, as companies of all sizes forced the pendulum of inventory management to be pushed to the austerity side, and then as the pendulum swung back to point to more desired ranges, there was a surge in activity, even though that total activity was not at pre-recession levels. Canada's fourth quarter GDP, however, showed a more balanced business mix, and actually depleted some inventories. Come April 30th, it is likely that US GDP will be far more balanced. The Institute for Supply Management's reports on manufacturing and non-manufacturing sectors imply a GDP report above 5%.

The sustainability of longer term economic growth still remains in question. It is likely that small and mid-size businesses are already engaging in tax planning, as income tax rates will rise in 2011, and other taxes in states are also slated to rise. This shift of business activity, which distorts the natural flow of business levels, can be a trap for forecasters and planners. It will be impossible to judge how much of this is going on until the middle of 2011, when it is all history.

Businesspeople must act and make decisions every day. While they should cast a wary eye at 2011, they should recognize that there is a small surge of improvement that will be reflected in 2010's economic data. Be cautious, as all business managers should, but focus on opportunities that the rising economy offers, while it lasts.

The improving economic data will not include robust employment growth. There are some very positive signs in recent employment reports, but we can't forget that the unemployment rate is still nearly 10%. Even if it drops to 8% by the end of the year, which it might, it will still be faced with the friction that taxes and regulations that start in 2011 and then only intensify for the years following, that may lock in unemployment above the 8% level for some time.

The economy is probably out of recession in the manner that academicians judge it. It will be very interesting to see where they set the upturn, as employment levels play a big role in their date selection. They do not use the old rule of thumb of two quarters of decline as the start and two quarters of increase as the end, but actually take their time in looking at many factors. Remember, they did not assert that we were in a recession until 11 months after the downturn, in their historical examination of things, had started.

For certain, the phrase “business as usual” should be eliminated from the business leaders vocabulary, especially for printers. It's critical to remember that the forces of digital media are far stronger that any potential stimulants to print demand that might have come from a growing economy three decades ago. The reasons for wise consolidation are still in play, and increasing the diversity of product offerings into communications and especially its logistical aspects, are essential for printing organizations to navigate this economy. Despite what is likely to be a strong GDP report, total commercial print shipments for January and February declined by more than -6% compared to 2009, which was already a bad year. Blame it on the reasons the NASDAQ is rising: a broader, faster, and more diverse communications infrastructure, some of which puts access to the world's information and entertainment in a device the size of one's hand, and as of April 3, not much larger than a sheet of paper.

* * *

Don't forget to download the new book, “Disrupting the Future,” which is available at no charge.