Many people confuse debt and deficit when they see it as part of the Federal government's annual budget. Deficit is the annual shortfall between a government's spending and its revenues. Debt is the accumulation of all of the deficits and surpluses of the prior years in that government's history.

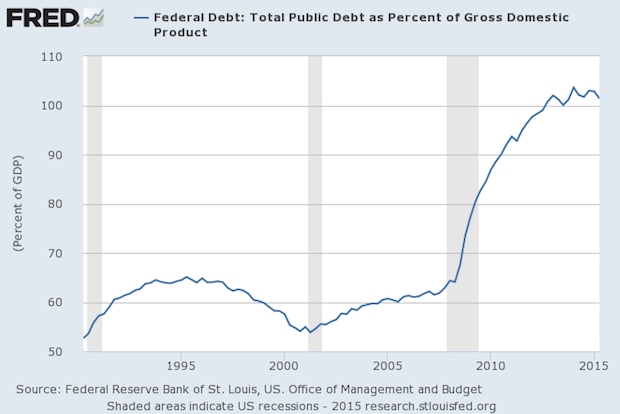

The chart below shows the accumulated deficits as a percentage of that year's Gross Domestic Product. When debt is at 100% that means that it is the same size as the economy, in the range of $18 trillion. On a GAAP basis (Generally Accepted Accounting Principles) that takes into account future obligations, the Federal debt is approximately 5x annual GDP. Among the concerns about the debt is the current interest rate environment.

With debt at $18 trillion, a +1% change in the interest rate paid by the government will increase Federal spending by $180 billion. The markets for government obligations are influenced by the actions of the Federal Reserve; a rate increase may decrease the value of obligations held by investors, pension funds, and the instruments purchased by the Fed in its Quantitative Easing initiatives. The Fed is designed to be an apolitical and independent organization, but the political pressures on the Fed as their actions affect government spending are likely to be significant once the Fed gets on a course of meaningful rate increases. Those rate increases may play a role in increasing debt as a percentage of GDP.