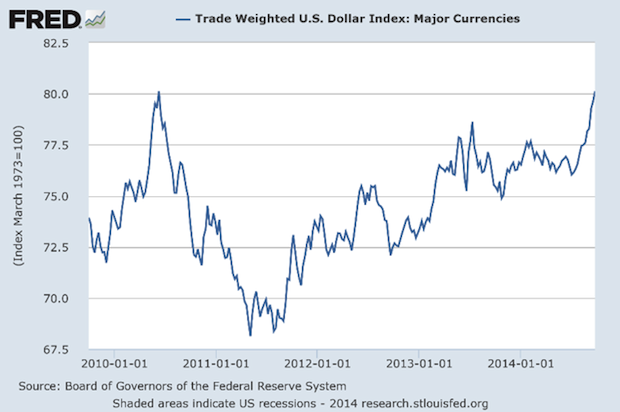

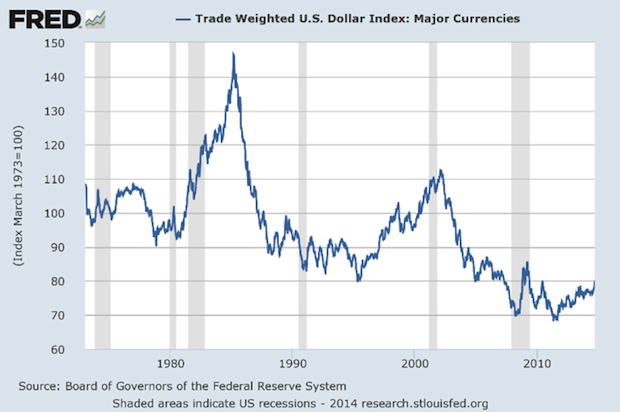

There's been a lot of interest in the stronger dollar for many reasons. Some consider it a safe haven during times of global tensions. Others say it's a bounce off a bottom. Still others consider the dollar the least ugly of all the major currencies. But is it really stronger. The first chart shows it rising for the last three years. The second chart shows about forty years of jagged downtrend. What is it? It depends on your perspective. If you're engaging in a cross-currency transaction that must be done today, you're stuck with what it is at this moment. Much of the dollar talk is from Wall Street traders whose livelihood depends of that arbitrage opportunities in short-term moves of exchange rates. Most businesspeople would be better off ignoring the trader talk and concentrating on long term trends. Sales cycles, product development, and strategic implementation take years to plan and execute, and future exchange rates are not reliably predicted for major currencies. Often the best way of hedging is to have business activities, back and forth, in multiple countries, and not just one. If you're always on one side of the currency transaction, you are more prone to having high peaks and low valleys related to rates. But if you are consistently involved in cross border transactions many of those fluctuations can be balanced out.