Introduction

Today’s whirlwind of transformation is creating havoc in the graphic communications market, bringing new opportunities as well as threats. The industry continues to implement new technologies that change how print is produced and how print service providers (PSPs) interact with clients. While many PSPs are deploying new services or evolving into marketing service providers, others are focused on profiting from niche opportunities in print. Later this month, InfoTrends will release a new study entitled Production Printing in North America: Understanding Industry Transformation.

Over 650 firms were surveyed in the course of this study. When respondents were asked how their revenues had changed between 2012 and 2013, 66.2% reported that they had experienced growth. Meanwhile, 25.6% of respondents indicated that their revenues had remained flat and only 8.1% experienced a decline year-over-year.

Five Key Factors for Success

This study examined various industry segments and drivers for success among PSPs. Service providers of all sizes are facing new business challenges and unprecedented complexity, but the winners in the marketplace demonstrated clear differences in the strategies that they deployed. InfoTrends uncovered five key factors that differentiated the winners from the losers.

A Focus on Value-Added Services

The high-growth firms clearly understand that today’s market isn’t just about competing for print. These firms are focused on competing across the entire value chain from strategy and creative to fulfillment. Growth companies also understand that the competition is more than just print, and an investment in digital print technology doesn’t necessarily generate stronger business results. The competition is associated with new communication technologies combined with print services.

Study results showed that:

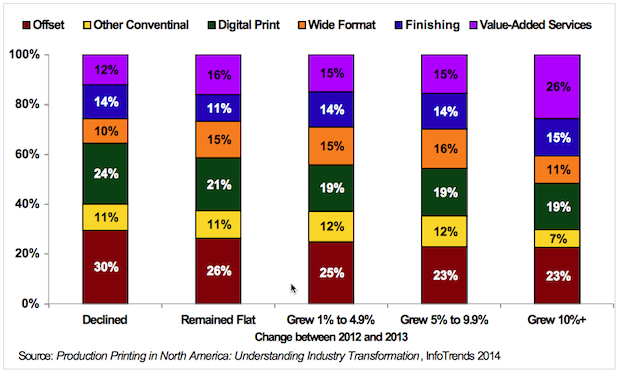

The print service providers that grew 10% or more attributed the highest share of their revenues (26%) to value-added services.

The print service providers with declining revenues attributed the highest value to conventional printing (41%, compared to only 30% for the companies that grew 10% or more between 2012 and 2013).

The share of revenue from digital print was fairly constant across all growth bands. This suggests that while digital print is important, it must be integrated with additional services.

Figure 1: What percentage of your revenue comes from the following sources?

The study also showed that:

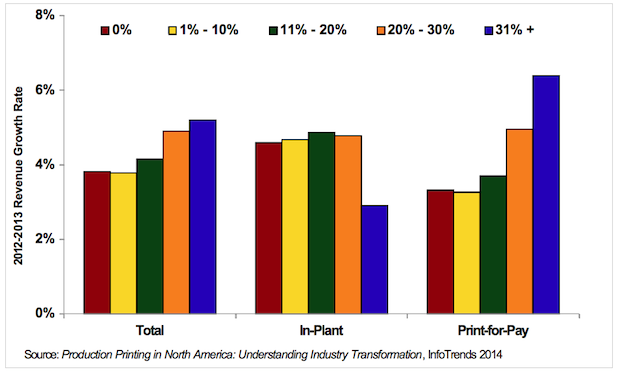

Print service providers with the greatest percentage of revenue from non-print, value-added services experienced the greatest revenue growth from 2012-2013

Meanwhile, in-plants that focus on print services in today’s market are succeeding because they are able to produce printed products at lower costs than PSPs or based on convenience and turnaround. In-plants have not been able to provide the same cost benefit for value-added services. In-plants also have fewer resources to invest in value-added capabilities and infrastructure.

Figure 2: Between 2012 and 2013, how much of your company’s revenue growth came from value-added services?

Web-Enablement is Integral to the Mix

We have been hearing for years that web-to-print can create tremendous benefits for your customer base. The key value propositions that service providers tout include brand consistency, customized content, better digital asset management, budget and inventory control, and a better approval process. A key message from the study was that the winners in the market are driving substantial revenues via web portals.

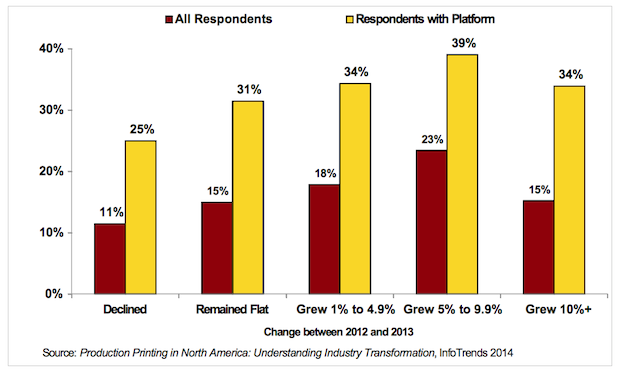

The companies that experienced the highest growth between 2012 and 2013 reported that more of their print revenues came from e-commerce or web-to-print systems. Companies who experienced declining revenues but had a web-to-print system had a significantly lower share of revenue coming through the system than providers who experienced revenue growth. Growth companies are driving more business through their web-to-print systems. In today’s market, end customers are seeking the convenience that web enablement delivers. Web access will continue to be a pivotal offering for future business growth.

Figure 3: What percentage of your print revenues come from your web-to-print/e-commerce system?

Variable Data: Winners Get It!

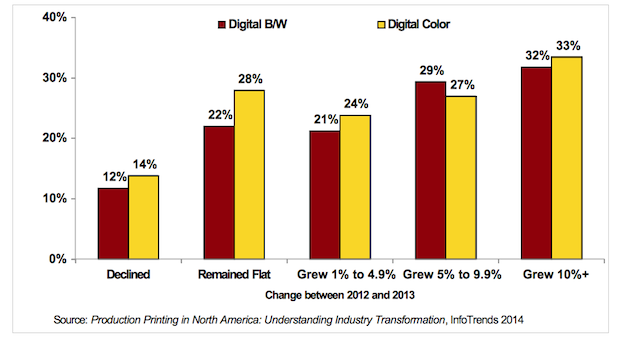

Personalization adds value. The most successful providers are delivering true one-to-one marketing solutions. They are able to merge variable text and graphics and digitally print an array of communications directed to specific individuals. These PSPs are offering their clients variable information printing that more effectively reaches customers, prospects, and other audiences through materials that convey a truly individualized look and language. In addition to delivering value to consumers, variable data results in far better revenue streams for print service providers. Print service providers with declining revenues are primarily producing non-variable data jobs with their equipment. Those experiencing high growth are developing and delivering complex variable messaging for their clients.

Figure 4: What percentage of your print volume is attributable to variable data?

Investing in Sales and Marketing is Critical

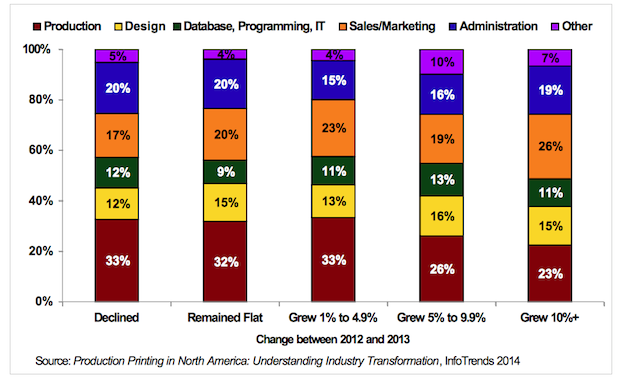

The most successful providers understand that sales and marketing skills are critical to overall success. These providers are focusing on increasing value for end customers by understanding their businesses better and offering the services that they value the most. While print quality will always be a critical consideration, end customers are seeking partners that can enhance the effectiveness of overall communications. When firms were asked to specify the share of their employees that fell within specific categories, high-growth firms reported that a greater percentage of their employees (26%) were engaged in sales and marketing. For firms that had seen a decline between 2012 and 2013, only 17% of their employees were involved in sales and marketing.

Figure 5: Approximately what percentage of your total employees fall into the following job categories?

Efficiency Reigns

The previous Figure also highlights that growth and efficiency are not contradictory. Although it is often difficult to achieve both of these goals at the same time, high-growth PSPs have proven that it’s not impossible. These organizations have developed strategies for value creation, yet they are investing in infrastructure and operating efficiencies. The result is fewer production workers—although firms that saw a decline reported that 33% of their workforce was production employees, companies that experience the highest growth said that only 23% of their employees were production-oriented.

The Bottom Line

In a recent speech, NAPL Chief Economist Andy Paparozzi stated, “We need to be prepared for what our industry is, not for what it was.” InfoTrends’ research provides proof that there are major differences in those firms that are growing and those that are declining. Competitors are being redefined in the market, so service providers that hope to thrive can no longer be complacent about adding value to the services that they offer to customers. InfoTrends’ benchmark study also explores investment plans, current and future service offerings, revenue expectations, and the impact of digital printing and software tools. In addition to identifying key print applications and market approaches that lead to success, it measures the pace and impact of industry consolidation, M&A, and restructuring.

For more information on this study, contact Scott Phinney at (781) 616-2123 or via e-mail at [email protected].

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free