For the first few weeks of we featured articles focused on the corrugated packaging sector. For the next few weeks we will be focusing on the folding carton sector and will post interviews with Ben Markens of the Paperboard Packaging Council and Jay Willie of the Independent Carton Group.

To help us introduce the various packaging sectors to the growing WhatTheyThink Labels & Packaging readership we asked PRIMIR if we could pull excerpts from their 2012 study that Karstedt Partners was commissioned to write titled Packaging: Evaluation of Vertical Markets & Key Applications. This study was unique to many industry studies in that it looked at the force being placed on Brand Owners, the originator of packaging orders. Taking this focus a step further the study looked in-depth at the major vertical markets of food, beverage, household, personal care and healthcare to see what will be driving packaging demand in these verticals and thus driving the supply chain. Following are some of what we brought to PRIMIR members surrounding the folding carton sector. The full table of contents for the report can be downloaded here.

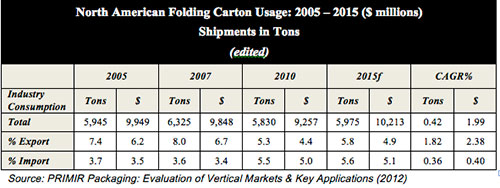

The growth in the folding carton sector is projected to mirror that of consumer products growing at a rate that matches GDP.

Insights From Converter Interviews

The research team conducted over 180 interviews with constituents all through the packaging supply chain. Following are some excerpts from those interviews with folding carton converters.

The folding carton converters indicated that they are considering moving between flexo and offset printing processes over the next five years. Discussions indicated even movement in-and-out of each process. Both sides of these movements claim high investments and prepress costs are detrimental for flexo adoption and the lower overall operating and finishing costs of flexo over offset on the opposite side.

Carton manufacturers say they need to more effectively manage production orders that are shrinking in size and increasing in frequency. They are actively seeking solutions that allow them to produce more orders while maintaining overall production volumes. This is not simply obtained by purchasing presses that have quick changeovers. This plan moves a bottleneck from one process step to another. Carton converters are searching for solutions that truly transform their operations for the better.

In discussions with a carton manufacturer who recently installed a highly automated large format sheet fed press, he states that one of the major challenges he faces is feeding the press jobs and clearing the table after it. By this he means that prepress has to have fresh printing plates ready throughout the production day, and pallets of board have to be continually loaded into the feeder to assure the press does not have to wait for raw materials. As soon as the press needs to wait for input materials, efficiency and profitability are erased. On the output end, he notes, the bottleneck soon shifts to the die cutting process, which is tuned for fewer changeovers and more volume.

Another area of wasted time and resources is the practice of maintaining inventories of finished goods for customers. In speaking with converters of all types over the years, this practice is seen as a ‘necessary evil’ that customers need and converters provide. Most say it has gotten a lot better, but it still is a major drain on profits for both the converter and ultimately the customer as well. JIT was offering relief to this practice but in reality it has marginal success. Converters still manage inventories for customers opting for ‘just-in time’ deliveries rather than ‘just-in time’ manufacturing.

For most carton manufacturers, quality is a given, there is no discussion about cutting quality to gain productivity or flexibility. The quality standpoint is one of the reasons they tend to stick with technologies they know as reliable. As mentioned earlier, there are mixed messages regarding carton press preferences shifting from offset-to-flexo to take advantage of inline processing available in narrow and mid-web flexo presses for cartons. Converters familiar with flexo printing have a first-hand understanding of the quality of high definition flexo and what is required to produce flexo quality printing. Converters that have little or no first-hand experience with flexo, believe that the cost and learning curves are too steep to make a viable transition. Suppliers interested in bringing flexo presses to the carton segment have to overcome significant inertia, which includes solid ROI data to substantiate the advantages of such systems.

Interest in digital printing is high, but participation is limited... This is not to say that carton manufacturers are not interested in digital printing, on the contrary, interest in new press offerings at drupa 2012 was high among carton converters. This segment eagerly awaits a solution that offers an alternative to running orders on equipment that is not equipped to manage them consistently and effectively.

However, digital solutions bring on a similar series of process issues, most notably what happens after printing, when coating, die cutting and folding and gluing is needed. The issue of die cutting is addressed by digital die cutting that uses lasers and special creasing methodologies. This was shown at drupa 2012 as well as other new technologies that show promise in helping to alleviate these production bottlenecks.

The interviewed carton converters believe that their customers are more ‘value-oriented’ than ‘volume-oriented,’ by a 2 to 1 margin. Sixty percent say their customers would pay a premium for products or services that address unmet needs. This corresponds to the brand owners’ response. Specifically, folding carton packaging provides the most value to their brands. Overall, 72% of brand owners say they will pay more for products or services that satisfy their unmet needs.

As part of the study Karstedt Partners interviewed 122 Brand Owners in multiple vertical sectors as well as 60 converters and industry leaders to compile comprehensive trending information that will be affecting buying decisions for the next few years. For more on the study and to become a member of PRIMIR visit them at http://www.primir.org.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free