Transpromotional communications…such a fantastic business opportunity!

About Thinking Creatively

Thinking Creatively is about taking a step back…when you want or need to think strategically and creatively about your business…or about your customer’s business…or about a solution to a challenging business problem. The goal is to be one part inspiration and one part motivation. We hope to provide – over time -- thought-provoking advice, tools, ideas and company profiles that help get you to your next breakthrough. Your feedback and interaction is invited, welcomed and encouraged.

Thinking Creatively is made possible by the support of GMC Software Technology. Normally such features are for "Premium Members" only. However, because the topic is so timely and essential to all executives in the industry we asked GMC Software Technology to provided support for this series. Their support allows us to to present these articles free for all WhatTheyThink.com members.

It is great for those of you who have acquired the capabilities to offer it to your customers. And it can create incredible efficiencies and solid returns for those companies who interact with their consumers regularly through transactional vehicles like statements and bills.

Yet, who is really the "expert" and what is the way to create the most value in this emerging field?

My contention: If you think about the consumer first…if you think about what a consumer would value if they found the right messaging on their bill…then you (and your client) will be more likely to find breakout success and true marketing differentiation.

I contend that Transpro is much more than just putting the right offer on the right customer’s statement. It is thinking through how the message and the offer and the customer situation inter-relate to create a positive moment for the relationship between customer and seller.

A flatfooted way of repositioning Transpromo is to call it "Customer-Valued Relationship Information" – or CVRI. What will activate a consumer to not only be enticed but to also to be pleasantly surprised when they open their bill?

To illustrate, I’ve pulled five examples from my own mailbox. These are companies I regularly do business with, who have Transpromo opportunities that they are just plain missing.

Collectively, they could make me feel better about our relationship and the value that I receive from their service. Some are simple ideas. Some more bold and daring. Bottom line: If you think as the consumer – if you ideate around things a consumer would be delighted and pleasantly surprised to see – you can become a leading "pro" in transpromotional communications.

1. Going from confusion (paper bill) to enlightenment (online account)

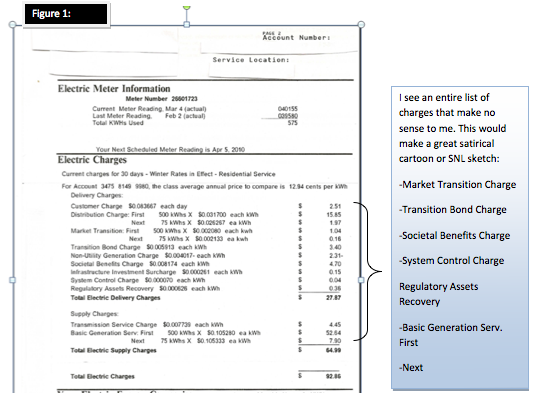

What could be more frustrating than to have to pay a big bill that creates more confusion than clarity? It is amazing what can happen when you go from a poorly constructed bill to a detailed and easy to understand online explanation. How can these two work products be from the same company? Let’s look at this utility’s paper bill (figure 1). What do all these charges mean? What is a "Market Transition Charge"? It is not explained like a lot of the other charges on the back of the bill.

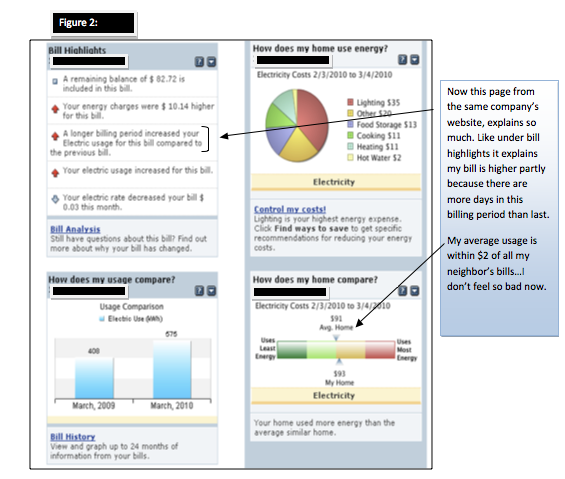

Then there is the online account from this same company (figure 2). Here is a snippet from that site. First, it explains why my bill is higher (more days in the billing period is one reason), I can also see that my bill is within $2 of the average bill (makes me not worry as much that I am out of the ordinary in my usage patterns). And, it actually breaks down the typical uses of electricity and how much they most likely contribute to the overall bill (this was after answering about 10-15 questions about the house).

Why wouldn't this electric company put a giant color display of some of this information on my paper bill...and encourage me to sign up online? Surely I’d be a more informed customer. And I’d be a lot less confused and resentful.

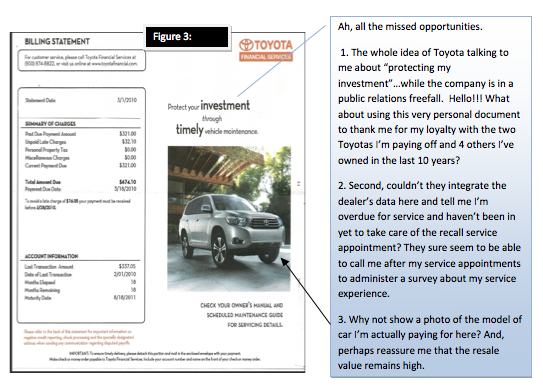

2. I’m blind in this one eye (Toyota seems to have to turned that blind eye to all those recalls we’ve been hearing about)

Here’s my Toyota Financial Services invoice for March, for my Camry (figure 3). You know -- the one that has been recalled. The one where the accelerator sticks. Well, I haven’t been to the dealer yet to get that fixed. But thankfully, I am getting a message on my statement that advices me to "protect your investment through timely vehicle maintenance". Oh, and it shows a picture of a vehicle that is not the one their billing me for.

I guess the folks at Toyota Financial Services haven’t been reading the papers or watching the television. So while their brethren at the "auto sales" arm of Toyota twist in the wind…and spend hundreds of millions of dollars on apology ads in the paper and on television…they forgot they could speak directly to me through my bill.

Oh, as an aside; why don’t they actually integrate their data with dealers so they could show when I was last in for service and remind me that it’s time for my 15,000 mile check up (the light on my dashboard is sure reminding me).

3. It’s all Greek to me (what am I being charged for? Really?)

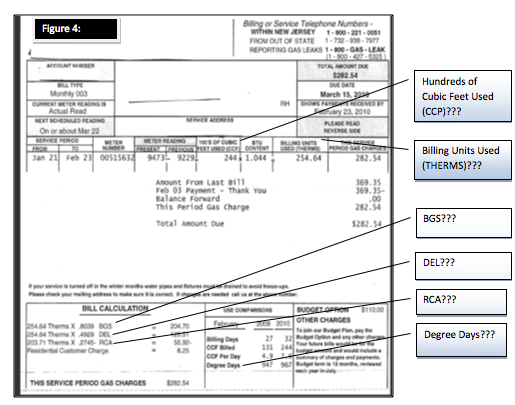

This gas bill (figure 4) has no fewer than 15 acronyms, abbreviations or numbers that I just don’t know a thing about, after two decades of home ownership.

And then, consider how easy they’ve made it to read the explanations on the back of the bill (figure 5). This is a direct scan…yes, it is so light, so screened back, that you could really only decipher it with a magnifying glass. Each section is numerically coded to make it "easy" to see what’s where. C’mon, is this for real?

So…what’s the message being delivered here?

4. The 20% Filled Page (white space is good, right?)

It always strikes me as funny when I see about 80% of a personalized page empty. Sure, I know. Some people’s bills need that space; others don’t. But, aren’t the data tools sophisticated enough to see the white space and fill it? See figure 6.

So what could I learn from my cable company that would be of value to me? Based on my "On Demand" usage, they might want to promote the Oscar winning movies and their "available dates" (I almost didn’t know "The Hurt Locker" was available for $4.99 on cable until the 2 nights before the Oscars). Also, they could have told me that another award winning movie, "Precious", was going to be available a week after the Oscars.

And surely they know I don’t have telephone service from them yet. Couldn’t they calculate the cost to me for adding it…and show some of the benefits that they highlight in their incessant on-air television ads? Just more missed opportunities.

5. If the left hand only acknowledged that there is actually a right hand (is any financial institution bold enough to be consumer focused?)

So I find this intriguing statement message on my checking account statement (figure 7); "Checking Customers Get Mortgage CASH BACK!" (you can’t tell from this image, but this is also a "20% filled page" just like my cable company bill).

Basically, I’ll get 1% back on my principal and interest payments at the end of the year on any new mortgage or refinanced mortgage at Chase, if I agree to have the payments automatically deducted from my Chase checking account. Nice.

Funny, I’ve been thinking of refinancing my current Chase mortgage. Even got a call recently from the local Chase branch about it. So, on the one document where they could actually show me – specifically – how much I could save if I did refinance the loan…there’s no reference. Not a mention. Am I surprised? Not at all. I’ve always wondered who will be the first bank to actually make a bold customer loyalty move -- like showing me how to save money on a product I already own with them.

It is counter intuitive. Why would a bank want to get me into a 5% mortgage when I’m paying 6.25% now? Wouldn’t they lose money?

The whole mortgage business is still gun shy from the recent crisis.. So is it any wonder that the statement message section on my Chase Mortgage statement is also so…empty…and sounding so, generic (see figure 8)?

What would I want to know? How about, what I could save over the life of the loan if I made one extra payment a month? Or, what the housing values are doing in the town where I live. Or, what circumstance would need to be met if I wanted to refinance?

So there you have it. Five companies…dozens of missed opportunities. If there is interest, I have many, many more examples to share.

And remember, to be the "Pro" in Transpro, take that first step and just think like a consumer.