- In-plants received an average of 105 jobs daily, with 42 arriving via their e-commerce/web-to-print websites. General PSPs typically handled 59 jobs daily, with only 12 coming in from their e-commerce sites.

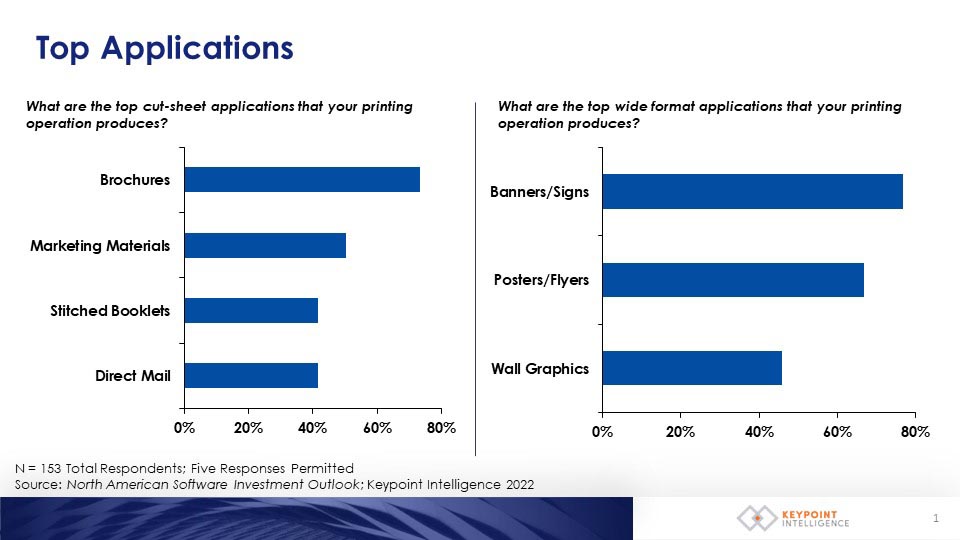

- The top narrow-format application types included brochures, marketing materials, stitched booklets, and direct mail.

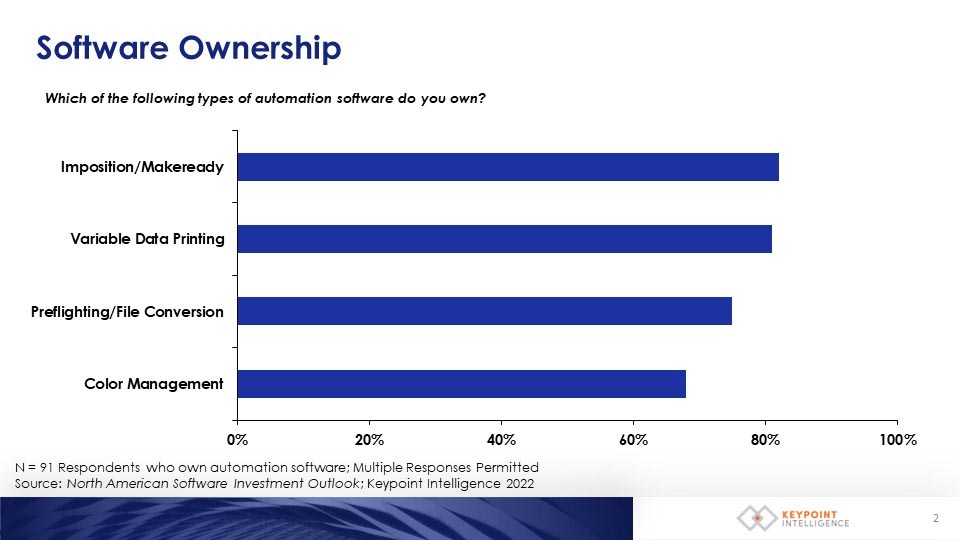

- Most surveyed establishments used impositioning/makeready and variable data printing solutions. Preflighting/file conversion and color management solutions were also quite common.

By Greg Cholmondeley

Introduction

In July 2022, Keypoint Intelligence conducted an online survey of 153 print service representatives. These general print service providers (PSPs), specialized PSPs, and in-plants from 33 US states and Canadian provinces answered questions about business financials, services and applications, software adoption, automation, and market perceptions.

The median annual revenue per employee was $177,000 for general PSPs, compared to $150,000 for in-plants. This difference is primarily due to differing business models; general PSPs must make a profit while in-plants provide required communication services to their institutions at cost.

In-plants received an average of 105 jobs daily, with 42 arriving via their e-commerce/web-to-print websites. Meanwhile, general PSPs typically handled 59 jobs daily, with only 12 coming in from their e-commerce sites. For general PSPs, most jobs were onboarded through direct sales (at 24 jobs per day). Finally, specialized PSPS received a whopping 107 of their 180 daily jobs through their direct sales forces, while only 8 came from e-commerce. The specialized PSP category includes a wide variety of providers such as service bureaus, direct mailers, label printers, book printers, and wide-format printers.

Top Applications

The top narrow-format application types included brochures, marketing materials, stitched booklets, and direct mail. The most popular wide format applications included banners/signs, posters/flyers, and wall graphics.

Figure 1. Top Applications

Software Adoption

Production software adoption and workflow automation are increasing—albeit slowly—in some areas. Most surveyed establishments used impositioning/makeready and variable data printing solutions. Preflighting/file conversion and color management solutions were also quite common, but the reality is that nearly every in-plant and PSP could benefit from them.

Figure 2. Software Ownership

More detailed analysis shows that in-plants are more likely to use print MIS features for workflow management and fulfillment. In contrast, commercial PSPs tend to primarily use print MIS for estimating.

Top Business Threats

When commercial PSPs and in-plants were asked about their top business threats, the top responses included rising costs, supply chain issues (e.g., paper availability and cost), and difficulty attracting/retaining employees.

In-plants and commercial PSPs apply production software solutions to address threats and achieve these benefits by improving their workflows. The top five workflow issues identified in this study include:

- Time-consuming billing and accounting

- Inventory & supplies management

- Errors and waste

- A high number of small jobs

- Not all steps are automated

The Bottom Line

As we move into the future, in-plants and commercial PSPs must continue to address fluctuating supply costs and availability, labor shortages, and ongoing market uncertainty. Successful PSPs will find ways to strengthen their operations and become more efficient by:

- Streamlining job onboarding and approvals with e-commerce and customer approval systems.

- Tightening inventory management and pricing responsiveness by implementing and fully utilizing print MIS capabilities.

- Ensuring employee efficiency by automating tasks and multiple workflow steps wherever possible.

- Enabling remote working to handle at-home staff needs, after-hours support, and multi-site production management by reduced staffing.

- Incorporating scheduling and planning software that identifies the most cost-efficient production techniques—including outsourcing where appropriate.

- Calculating their software automation return on investment (ROI) differently using up-to-date budgeted hourly rates and soft results. Production software and automation are no longer cost-justified by reducing headcount. Today’s issues are more about reducing workloads on overtaxed staff members while also recognizing positions that can be eliminated.

Subscribers to Keypoint Intelligence’s Production Workflow Solutions Advisory Service can access much more information on this study and related industry trends. If you’re not a subscriber, e-mail [email protected] for more information.

Greg Cholmondeley is a recognized expert on workflow automation, strategic planning, software solutions, and the printing industry. Before joining Keypoint Intelligence, he was President of PRINTelligence Consulting, where he analyzed and assessed production enhancement software solutions for vendor development and consumer understanding. He is a frequent speaker and panelist at industry events as well as a published author.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free