- The trend toward online purchasing will contribute to other factors, including print volume consolidation, the transition to inkjet, and even outsourcing.

- Print volumes are now shifting at an accelerated pace, with internet-based sales and economies of scale helping to make the big PSPs even bigger.

- Some people still question the sustainability of print and are pushing toward paperless, but this trend is likely to slow as print buyers become more educated and share their knowledge.

By German Sacristan

Introduction

We are currently experiencing uncertain times, but this lack of certainty is likely becoming par for the course in an industry that is evolving faster than ever before. Although these shifts can bring new challenges while also accelerating existing trends, they can also create new opportunities for growth. This article explores how ongoing trends are re-shaping the print ecosystem. The trends themselves are not new, but they are accelerating at an unprecedented pace and are poised to change our industry forever.

Trend 1: Online Purchasing

Having an online presence seems like a great opportunity, but this opportunity comes at a price. Once we enter a larger market (i.e., the internet) to sell our products, we can reach more customers—but we also encounter a greater number of competitors! With an online presence, the greatest challenge for printing companies can sometimes lie in figuring out who these competitors are.

Not all printing products are commodities, but they can be viewed as such based on the way that the print service provider (PSP) sells them or how print buyers perceive them. All other things being equal, items that are considered commodities are often purchased with price as the primary differentiator. Today’s PSPs must compete with very large online print corporations with economy of scale models that offer very low pricing. This trend toward online purchasing will contribute to other factors, including print volume consolidation, the transition to inkjet, and even outsourcing. According to a Keypoint Intelligence survey of 179 small and medium-sized businesses that make online purchases, more than 80% believe that their use of online ordering for purchasing printed materials will definitely or probably increase.

Trend 2: Print Volume Consolidation

Print volume consolidation has been going on for quite some time, with most print volumes coming from a small number of very large PSPs (e.g., Cimpress, Deluxe Corporation, Quad Graphics, R.R. Donnelley, Taylor Group). Print volumes are now shifting at an accelerated pace, with internet-based sales and economies of scale helping to make the big PSPs even bigger. The current paper shortage crisis may also favor large PSPs, which have the resources to purchase the larger minimum orders that some paper mills/merchants are requiring. Supply chain disruptions present a greater challenge to smaller PSPs.

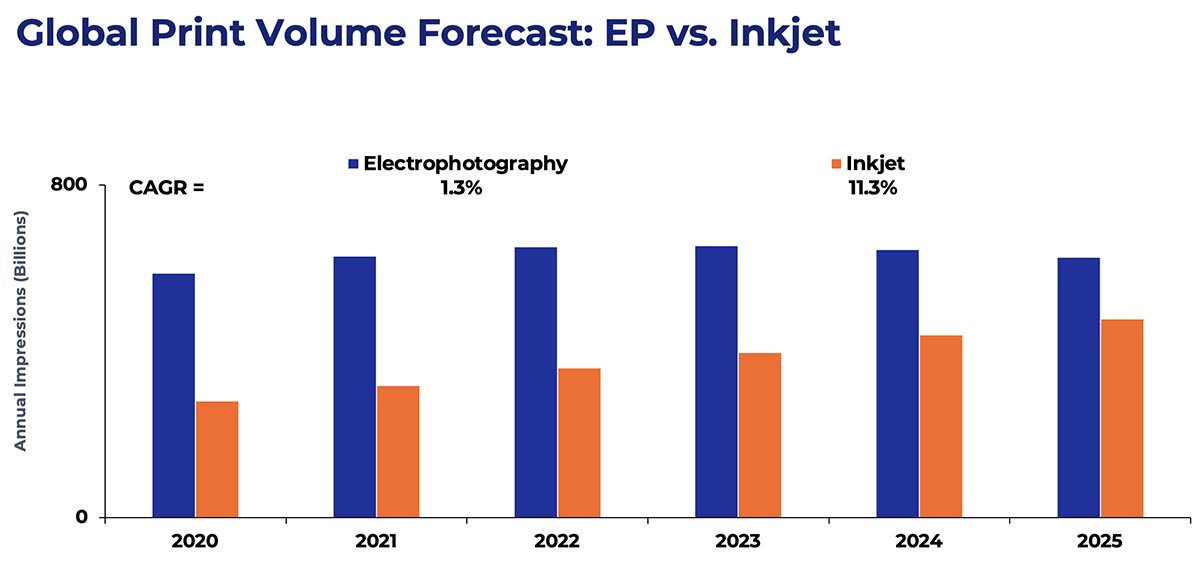

Print volume consolidation also favors inkjet technology and contributes to its higher projected growth. Larger PSPs will typically rely on inkjet to increase their productivity and reduce total cost of ownership (TCO). Furthermore, the volumes of these larger PSPs can better justify a larger capital investment in inkjet.

Figure 1. Global Print Volume Forecast—Electrophotography vs. Inkjet

Source: Global Production Printing Market Forecast; Keypoint Intelligence 2021

Trend 3: Outsourcing

Most printers choose to outsource something at some point because of capacity, cost, or lack of resources to produce or finish a specific print job. In this case, however, we are talking about a different type of outsourcing—the anticipated growth of print brokers.

According to a recent survey from Keypoint Intelligence, almost 90% of a PSP’s typical print job costs come from production. In these times of uncertainty and opportunity, more print businesses will likely focus more on promoting and selling print while outsourcing production to large PSPs that only service the trade and offer very low prices. This trend is already occurring in the online world; print brokers that don’t produce print will sell and distribute it via a PSP network.

Trend 4: Labor Shortages and Sustainability

Over time, labor shortages in the printing industry have only become more challenging. Some PSPs are investing in automation software and even robotics to reduce their costs and combat labor shortages.

Sustainability is also a growing concern. Print buyers want to be sustainable, and they need their customers to perceive them as such. Some people still question the sustainability of print and are pushing toward paperless, but this trend is likely to slow as print buyers become more educated and share their knowledge. In some cases, print might actually be better for the environment as its products are highly recyclable and may produce fewer greenhouse gas emissions than information and communication technologies (ICT).

Other Trends

Of course, the trends mentioned above are only a snapshot of the shifts that are occurring within our industry. Here are some others:

- With magazines, the growth in online subscriptions will likely shorten offset print run lengths—which favors digital printing.

- The physical mailbox is one of the least competitive channels from a marketing standpoint. This trend is expected to increase volumes of catalogs, brochures, and direct mail pieces that can be customized and linked to digital sources (e.g., QR codes, augmented reality, NFC tags).

- Printed books experienced a bit of a revival during the pandemic due to digital fatigue and an ongoing emotional connection with paper books. Digital printing volumes will likely increase due to the benefits of on demand printing and a drive toward shorter runs.

- Photo print volumes are expected to shift from traditional silver halide to digital print technologies due to workflow efficiencies, the quality and consistency of print, a greater variety of substrates, and the potential for lower costs. In addition, silver halide has been more impacted by supply chain disruptions and is viewed as less eco-friendly than digital printing.

- Consumers and businesses are increasingly demanding fast, preferably free shipping. Packaging is therefore expected to grow as more and more items are packed and shipped for delivery. In addition, paper shortages favor packaging as a sustainable and growing application. Some paper mills are even converting their machinery to produce more packaging materials.

The Bottom Line

It goes without saying that the COVID-19 pandemic changed many aspects of our world forever, and these changes will likely continue even as we (hopefully) continue to recover. There is no question that the pandemic increased the cost of printing a finished product. As a result, some print buyers might reduce the run lengths of their orders moving forward. This will favor digital printing in general, as well as some of its most popular applications.

German Sacristan is the Director of Keypoint Intelligence’s Production Print & Media group. In this role, he supports customers with strategic go-to-market advice related to production printing in graphic arts and similar industry segments. German’s responsibilities include conducting market research, industry and technology forecasts, custom consulting and development of analyses, editorial content on technology, as well as support to clients in the areas of production digital printing.

Discussion

By Joel Salus on Mar 31, 2022

Well, I can't (and therefore won't) speak to the broader/greater "Printing" Industry, but I would like to share my opinion about "prints on paper" regarding trends in the "reprographics" industry (which is a part of the overall Print and Graphics Industry).

Printing on paper (copying and digital printing, and, here I'm referring to "copying" and "digital printing" of "small-format" (letter, legal and tabloid size) documents is a business that is definitely in a declining mode. I used to print everything I created (Word documents, Excel documents), but, nowadays, I rarely print anything to paper. I print to digital files (pdf's primarily) and send the pdf files to those who need to read what I prepare. And, I am no different than customers who buy print services. Even wide-format prints are going to be subject to decline as more and more customers use digital displays to "show" their ads and messages. If you go to CDW's web-site, you will see how heavily they are promoting "digital" signage products, and, no, I am not referring to "prints from digital files", I am referring to systems that transmit images to display screens.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free