By John Nelson, Editor, Smithers

While there remains much uncertainty in the print industry after two years of unprecedented disruption, one of the strongest emergent trends post-pandemic has been the interest in more sustainable print processes.

This aligns with a broader emphasis on environmental responsibility that many organizations—including many print buyers—are adopting in the wake of the COVID-19 pandemic. The technical, regulatory, and market drivers for this are profiled in new Smithers study The Future of Green Printing Markets to 2026.

As the market continues to evolve, more and more print OEMs and substrate suppliers are emphasizing different environmental credentials in their marketing material, and this will become a more important differentiator across the next five years. Among the central changes will be the choice of print substrates, consumables used, and a favoring of digital (inkjet and toner) production.

Carbon Footprint

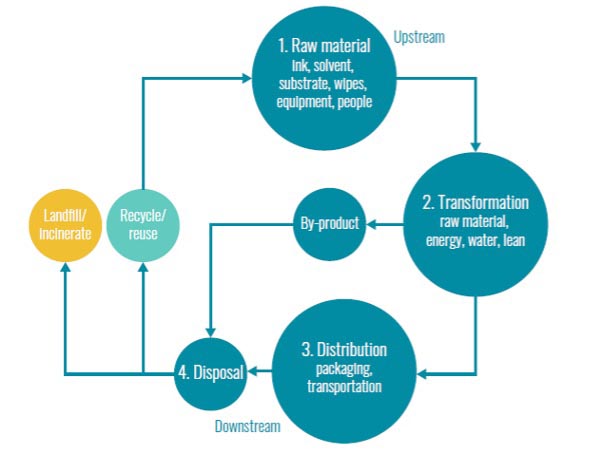

The most common printed material—paper and paperboards—do benefit from being easy to recycle. For this reason, they are often held up as materials that align perfectly with circular economy principles, but as lifecycle analyses have become more complex, green printing will become more than using a recycled or recyclable paper. It will broaden to include designing sustainable products that also focus on use, reuse, production, and distribution—potentially involving organizations at all stages of the supply chain.

Printing processes currently add to carbon emissions through the use of fossil fuel energy to run equipment, to transport raw materials and finished goods, and to support the process in general. The manufacturing and release of volatile organic compound (VOCs) from solvent-based printing processes, the manufacturing of paper and plastic substrates, ink, cleaning solutions, and so on, all add to these.

This is attracting attention from legislators too. The EU’s Green Deal policy platform is looking to set new limit values for larger heatset litho, gravure, and flexo presses in the future, as well controlling microplastic pollution from various sources, including unreacted fragments of ink films and varnishes.

Inks

Inks and especially solvent-based formulations are a target for many. Solvent inks are established in many print segments, but are considered the least environmentally friendly option due to their high content of VOCs. R&D is looking to replace the petroleum-based binder with alternative renewable resources, such as vegetable oil or soy. This does present challenges in print rooms as these inks dry very slowly and are less durable.

The main alternative is water-based ink sets with many released in the past two years. Many of these employ 100% biodegradable pigments, but some do still rely on less green materials, such as titanium dioxide or metallics. While a potentially greener solution, the ultimate ecological footprint of water-based ink has as much to do with how it is handled, stored, and cleaned as it does its ingredients. Water-based inks are only eco-friendly when one uses and disposes of them in a responsible manner.

An alternative is more work on waterless inks, or other technological innovations that use less water in production.

Substrates

Paper-based materials continue to boast strong environmental credentials—even if they are not infinitely recyclable. Each recovery and repulping phase means the fibers get shorter and weaker. Estimates of energy savings that can be realized due to recycling paper products vary greatly, although most studies indicate that energy savings of up to 57% are possible for newsprint, graphic papers, packaging, and tissue.

This has been long understood, and the processes for collecting, processing, and deinking is well established. This means collection rates for paper are high—72% EU, 66% US, and 70% Canada—while for plastics they are much lower. This is leading to a preference for paper materials where possible for print media, and a focus on print substrates that include more recycled content.

Digital Production

Digital presses are already proving more popular. This is a synthesis of improvements in their operation and print quality, and a fall in the average length of a print runs. Analog print methods such as flexo and litho-lamination struggle to offer the flexibility and agility some print buyers are now demanding.

In contrast, digital printing technologies allow brands to manage product lifecycles and their packaging needs more effectively. By being able to print what they want, when they want and how they want, brands can control run volume, frequency and graphic iterations with ease, aligning their supply chain to their marketing efforts and sales results. Also, digital printing does not require print plates, which delivers a host of environmental and cost benefits.

Online printing—including web-to-print platforms—with automated workflows can improve production efficiencies and waste reduction further.

With 2021 set to be a pivotal year for the world’s efforts to contain climate change, these and other important timely trends for the industry are examined critically in The Future of Green Printing to 2026.

The Future of Green Printing to 2026 profiles the evolution of circular economy principles, key legislative initiatives, and the impact on all major print product segments. This definitive business strategy is available to purchase now priced $6,500 (€5,250, £4,750). Visit https://www.smithers.com/en-gb/services/market-reports/printing/the-future-of-green-printing-to-2026 for more information.

Circular economy model for the print industry

Source: Smithers

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free