- The share of employed persons working from home on days they worked reached 42% in 2020, which was almost double the share that was seen in 2019.

- The overall population spent 10% less time working in 2020 than it had in 2019, fueled by fewer people working due to layoffs, furloughs, and illness.

- Another finding from the survey was that the average time per day spent purchasing goods declined from 28 minutes in 2019 to 23 minutes in 2020.

By Christine Dunne

Introduction

The US Bureau of Labor Statistics recently released the results from its new American Time Use Survey. This study explores how Americans spend their work and leisure time, and the most recent survey compares information from May 10 through December 31, 2020 to the same period in 2019. A comparison of these two timeframes illuminates how the COVID-19 pandemic changed Americans’ time use habits. The results of this survey are quite interesting when viewed through a print industry lens, and some top-level findings are highlighted here.

Key Survey Findings

More People Are Working from Home

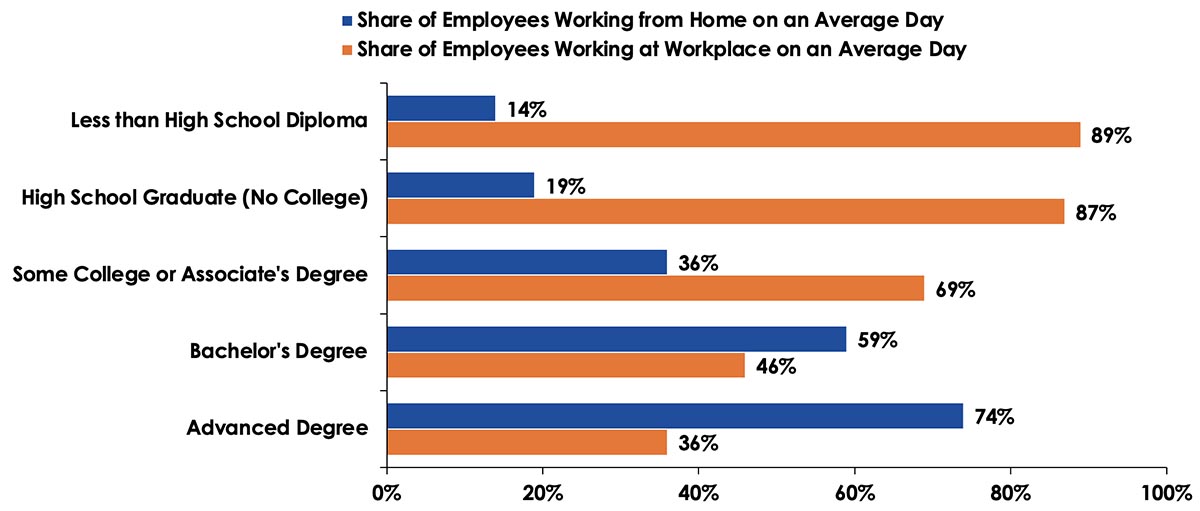

According to the results of the most recent survey, the share of employed persons working from home on days they worked reached 42% in 2020. This is almost double the share that was seen during the same (pre-COVID) period in 2019. As shown in the figure below, people with higher levels of education were markedly more likely to be working from home.

Figure 1. Share of Employed Persons Who Worked at Their Workplaces vs. at Home

Between 2019 and 2020, the largest increases in at-home working occurred in fields like financial activities, professional/business services, and education/health services. Meanwhile, at-home working levels were lower in fields like leisure and hospitality, transportation and utilities, and manufacturing.

Although printers and packagers were deemed essential businesses early on in the pandemic, this does not mean that all employees and clients immediately returned to their offices. Some staff members were brought back into print shops, but printing companies also had to accommodate workers and customers that could no longer meet face-to-face. New remote workflows were developed to maintain print operations, sell printed products, and ensure customer satisfaction. While many of these workflows will likely remain to some extent, more workers are expected to return to the office as 2021 progresses. This suggests that in-person business interactions will once again become a centerpiece of the print industry’s culture.

Less Time is Being Spent Working Overall

The American Time Use Survey revealed that the overall population spent 10% less time working in 2020 than it had in 2019. This decline was fueled by fewer people working due to layoffs, furloughs, and illness. Among those respondents who continued to work during the pandemic, their average workday length declined minimally from 7.52 hours in 2019 to 7.49 hours in 2020.

As the virus threat (hopefully) diminishes and more people resume work, more people and businesses will likely require (and have the resources for) printed output—whether this is produced via in-house technologies and capabilities or outsourced arrangements. According to the US Bureau of Labor Statistics, the US economy added 943,000 jobs in July 2021. This was the largest monthly gain since August 2020, and the unemployment rate shrank from 5.9% to 5.4% during that same timeframe. These new workers will have more money to spend on items like photo gifts, customized apparel, and business cards.

Less Time is Spent Purchasing

Another finding from the survey was that the average time per day spent purchasing goods declined from 28 minutes in 2019 to 23 minutes in 2020. This decline was driven by the share of people engaged in this activity on a given day, not the average amount of time that shoppers devoted to this activity.

Over time, brick-and-mortar shopping is expected to open up further. Meanwhile, more people will have the means to make purchases (driven by increased employment). Both of these factors have positive implications for the production print sector—especially at the local level where in-person interactions can provide value to customers and drive business. That said, it is also important to remember that many people became accustomed to online purchasing methods during the lockdown phase of the pandemic. Print providers were often chosen based on price, shipping speed, low-cost (or free) shipping costs, and online reviews. Even after the pandemic subsides, some people may choose to continue acquiring print in this manner. In addition, the online purchasing habits that consumers recently picked up may continue to affect business-based purchasing decisions.

The Bottom Line

There’s no question that this global pandemic has been full of surprises—bad and good. Even in the short time since the results of the most recent American Time Use survey were released, the impact of the COVID delta variant has grown. In the 14-day period ending August 23, for example, new COVID-related deaths rose 95%. This might cause some individuals to revert back to behaviors that were more commonplace during the height of the pandemic, including keeping children at home/continuing remote learning, working from home or taking time off from work, and refraining from shopping in physical locations.

Sadly, some of the optimism associated with a potential return to “normal” has dissipated as new threats arise. This reintroduces challenges to many sectors of the economy—like printing—that have heavily relied on a fully functioning economy and face-to-face interactions. Keypoint Intelligence is closely tracking the evolution of the delta variant to better determine how it will affect future print purchasing behaviors. We will provide additional assessments and predictions for the production printing market as the situation unfolds.

Christine Dunne is a Consulting Editor for Keypoint Intelligence’s Office Technology & Services Group. Her responsibilities include responding to client inquiries, conducting market research and analysis, and providing coverage of industry events. Ms. Dunne has written extensively about search engine optimization and pay-per-click advertising.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free