In October and November 2020, WhatTheyThink’s Business Outlook Survey asked print business executives and owners about their 2020 business conditions, business challenges, biggest perceived opportunities, and investment plans. We also asked about respondents’ opinions of virtual events, as well as their 2020 hiring plans. The results of this survey—and much much more—are included in WhatTheyThink’s Printing Outlook 2021 special report. Here are some of the top-level findings from that report.

In October and November 2020, WhatTheyThink’s Business Outlook Survey asked print business executives and owners about their 2020 business conditions, business challenges, biggest perceived opportunities, and investment plans. We also asked about respondents’ opinions of virtual events, as well as their 2020 hiring plans. The results of this survey—and much much more—are included in WhatTheyThink’s Printing Outlook 2021 special report. Here are some of the top-level findings from that report.

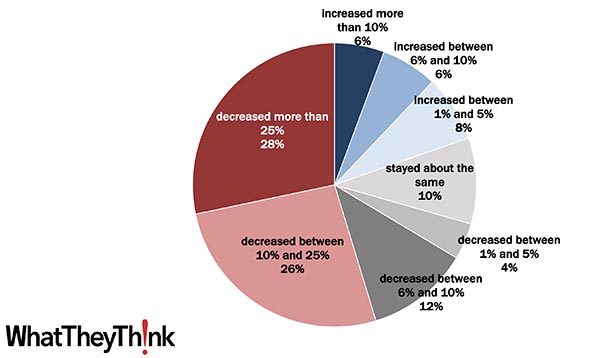

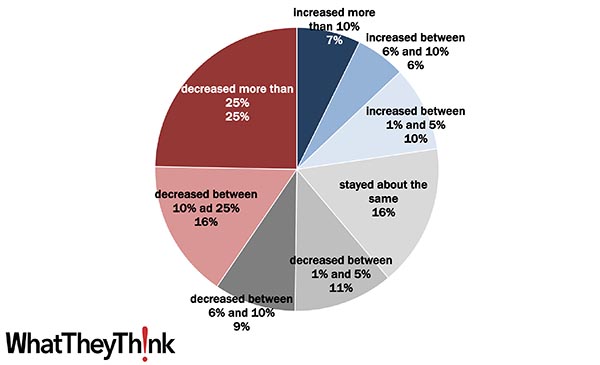

Revenues

- 28% of print businesses said that revenues for 2020 had decreased more than 25% compared to 2019.

- 26% said revenues had declined between 10% and 25%.

- 12% said revenues declined between 6% and 10%.

- 4% said revenues had decreased between 1% and 5%.

- 10% said revenues had stayed basically the same and a happy 12% said revenues increased in 2020 compared to 2019.

We calculated an average change in revenues of -12.6% from 2019 to 2020, compared to +4.1% from 2018 to 2019.

Figure 1. In terms of your 2020 revenues at this location only, how do they compare to 2019?

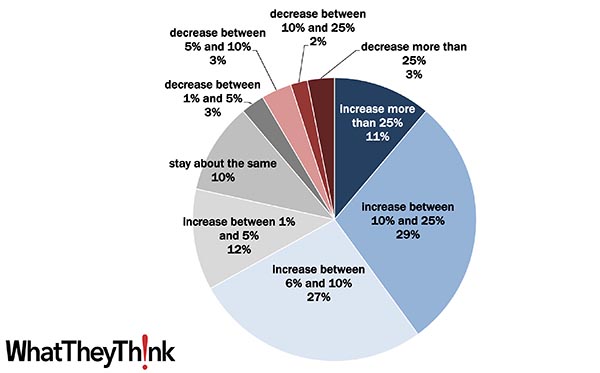

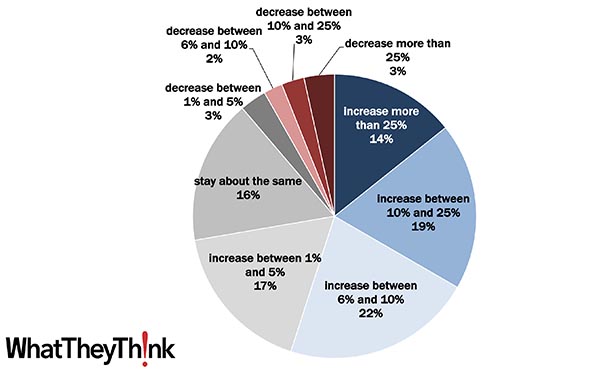

The general expectation is that business is going to rebound in 2021, although not completely.

- 11% of respondents expect revenues to increase by 25% or more in 2021 vs. 2020.

- 29% expect 2021 revenues to increase between 10% and 25%.

- 27% expect revenues to increase between 5% and 10%.

- 11% expect revenues to decrease in 2021 over 2020.

Overall, printing establishments expect a +9.1% change in revenues in 2021.

Figure 2. How do you expect your 2021 revenues at this location to compare to 2020?

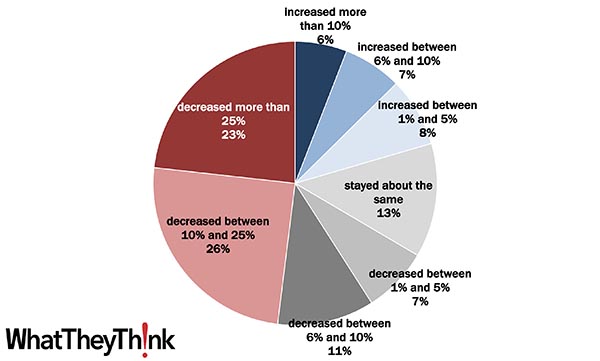

Jobs/Orders

- 23% of print businesses said jobs for 2020 had decreased more than 25% compared to 2019.

- 26% said jobs declined between 10% and 25%.

- 11% said jobs declined between 6% and 10%.

- 7% said jobs decreased between 1% and 5%.

- 13% said the number of jobs had stayed basically the same, and for 21%, jobs increased in 2020 compared to 2019.

We calculated an average change in jobs of -10.8% from 2019 to 2020.

Figure 3. In terms of your 2020 jobs/orders at this location only, how do they compare to 2019?

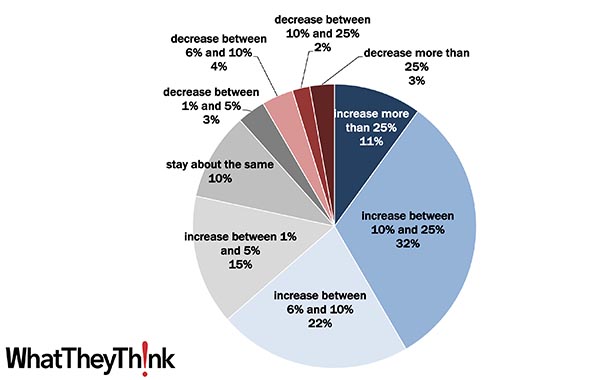

Shops are anticipating a return of volume but, again, not at a level that will make up for jobs lost in 2020.

- 11% of respondents expect jobs/orders to increase by 25% or more in 2021.

- 32% expect jobs to increase between 10% and 25%.

- 22% expect jobs to increase between 6% and 10%.

- 15% expect jobs to increase between 1% and 5%.

- 10% expect jobs to stay about the same, and 12% expect jobs to decrease in 2021.

The average expected change in jobs/orders is +9.0%.

Figure 4. How do you expect your 2021 jobs/orders at this location to compare to 2020?

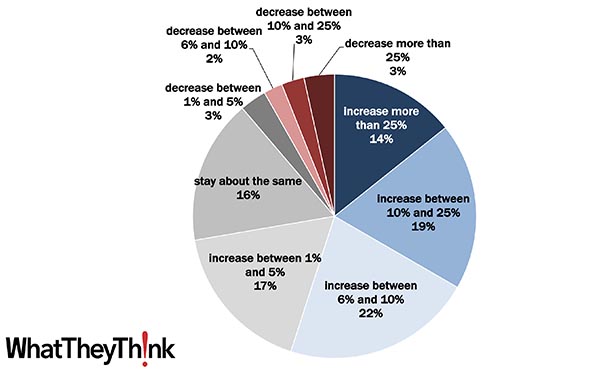

Profitability

- 25% of respondents said profits decreased 25% or more from 2019.

- 16% said profits had decreased between 10% and 25%.

- 9% said profits had decreased between 6% and 10%.

- 11% said profits had decreased between 1% and 5%.

- 16% said profits had remained about the same, although 23% said that profits had increased over 2019.

The average change in profits was -9.6%.

Figure 5. In terms of your 2020 profitability, how did it compare to 2019?

- 14% of respondents expect profits to increase 25% or more in 2021.

- 19% expect profits to increase between 10% and 25%.

- 22% expect profits to increase between 6% and 10%.

- 17% expect profits to increase between 1% and 5%.

- 16% expect profits to stay about the same, and 11% expect profits to decrease in 2021.

The average expected change in profits is +8.0% from 2020 to 2021.

Figure 6. How do you expect your 2021 profitability to compare to 2020?

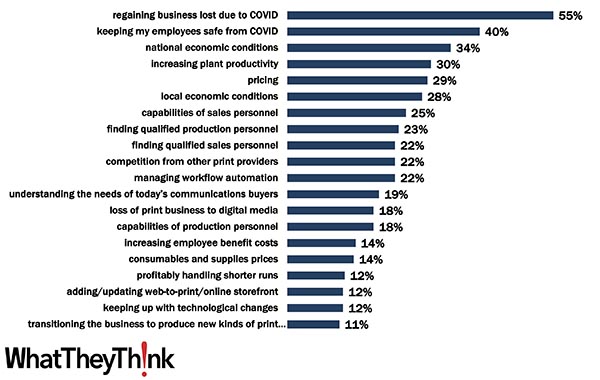

Top Business Challenges

- The number one challenge this survey was “regaining business lost due to COVID,” selected by 55% of respondents.

- Number two is “keeping my employees safe from COVID,” selected by 40%.

- Number three is “national economic conditions,” selected by 36%, up from 22% in last year’s survey.

- Number four is “increasing plant productivity,” selected by 30%, way up from 18% last year and an all-time high for this challenge.

- At number five is “pricing,” selected by 29%, unchanged from last year, although it was the number one challenge last year.

Figure 7. In the next 12 months, which of the following will be your biggest business challenges?

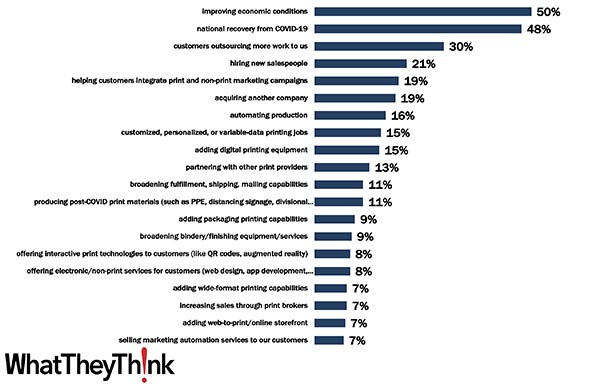

Business Opportunities

- The number one business opportunity this survey is “improving economic conditions,” selected by 50% of respondents, the highest this opportunity has charted in many years.

- Number two is “national recovery from COVID-19,” selected by 48% of respondents.

- Number three, way down at 30% (a three-year-low), is last year’s number one: “customers outsourcing more work to us.”

- Number four is “hiring new salespeople” at 21%, up from 15% last year.

- Number five is “helping customers integrate print and non-print marketing campaigns” at 19%, down one point from 20% last year.

Figure 8. In the next 12 months, which of the following represent your best new business opportunities?

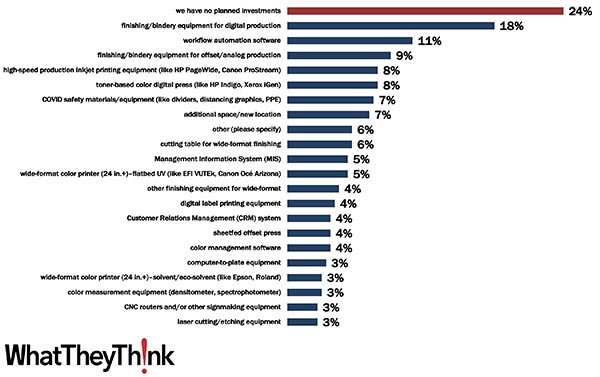

Planned Investments

What are print businesses planning to buy in 2021? Not a great deal, or at least nothing that requires advanced planning and a formal investment process.

- The top response—selected by 24% of respondents—was “we have no planned investments.” Pre-COVID, 32% said they had no planned investments for 2020.

- The number one actual item is “finishing/bindery equipment for digital production” at 18%, up from 16% last year.

- Number two is “workflow automation software,” selected by 11%, down from 14%.

- Number three is “finishing/bindery equipment for offset/analog production” at 9%, up from 7%.

- Digital printing systems, both production inkjet and toner, round out the top five at 8% each.

Figure 9. Which of the following investment items have you budgeted for and plan to acquire in the next 12 months?

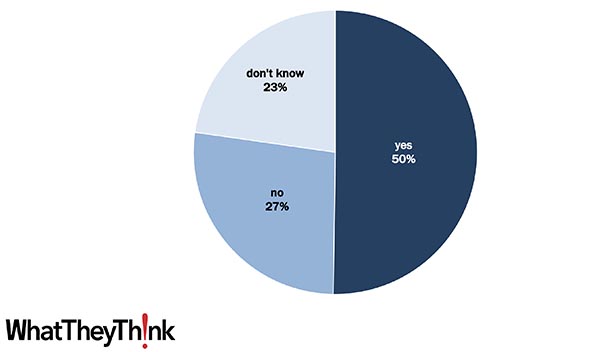

Hiring Plans

One of the most discussed topics of the past few years, even before COVID, was that of staffing and the problems that print businesses have been having in attracting employees.

- 50% of respondents said they plan to hire in the next 12 months, up from 47% who said this in Fall 2019.

- 27% said they have no hiring plans, down from 36% in Fall 2019.

- 23% said they “don’t know,” which reflects a fair amount of uncertainty.

Figure 10. Are you considering hiring/adding staff in the next 12 months?

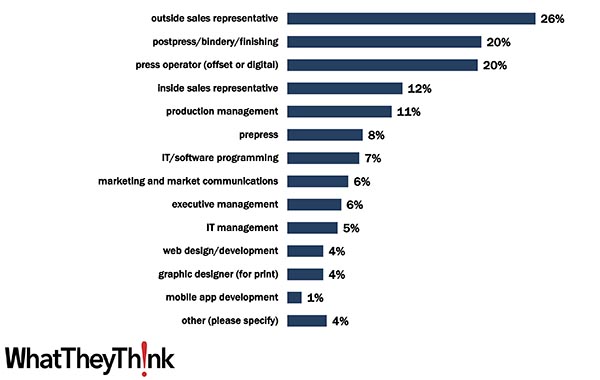

The COVID crisis hasn’t altered the types of positions for which print businesses are hiring.

- At the top of the list, as usual, is “outside sales representative” at 26%, up from 22% in Fall 2019.

- Number two is a tie between “postpress/bindery/finishing” (20%, up from 12%) and “press operator” (20%, up from 8%).

- Number three, “inside sales representative” dropped from 17% to 12%.

Figure 11. If yes, for what positions are you looking to hire?

Virtual Events

We had also asked a few questions about virtual events—the top-level results of those questions can be found in Cary Sherburne’s “Virtual Events Pros and Cons” feature that ran earlier this month.

Get the Full Report

The complete Printing Outlook 2021 report includes all our survey data broken down by establishment size, as well as industry statistics from third-party sources, extensive macroeconomic commentary, industry trends to look for in 2021 and beyond, and our industry forecast to 2030. The report can be purchased in our eStore at https://store.whattheythink.com/downloads/printing-outlook-2021/.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free